You are here

Home ›Food and Fuel Price Rises: Inflation Returns to Centre Stage

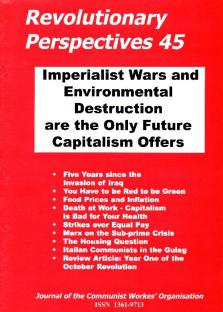

Image - Mexican demonstration against rising maize and tortilla prices

Whatever else has changed with the advent of today’s global, supposedly free-market capitalism, in-built inflation remains a fact of life. It was the “runaway” inflation of the 1970s and 1980s which encouraged the advanced capitalist states - those with the lowest rate of accumulation - to go global and abandon attempts to shore up the national economy by ever-larger injections of state aid. The myth that Keynes had found a way to overcome capitalism’s cyclical accumulation crisis simply by resorting to the printing press was shattered, or as the UK prime minister at the time, James Callaghan, announced:

We used to think that you could spend your way out of a recession - that option no longer exists.

September 1976, after the UK had been obliged to borrow from the IMF Yet, even though the threat of hyperinflation and/or currency collapse persuaded major states, at least in the EU, to impose limits on budget deficits and agree on competition rules to curtail state subsidies to industry, state spending as a proportion of national income remains roughly the same, while in the Anglo-Saxon countries especially “deficitfinancing” has taken on new meaning with the gargantuan increase of personal debt on the back of credit cards and mortgage-backed loans linked to rising house prices.

In a wider sense, too, deficit spending has ballooned in capitalism’s private sector, where the exponential growth of transactions involving fictitious capital have reached a dimension that would be unrecognisable to Keynes.

Even so, states - through their central banks and other regulatory bodies - still assign themselves the task of stimulating economic growth and maintaining financial stability by the essentially Keynesian mechanism of manipulating the flow of money and credit. The fact that in the post- Bretton Woods world of deregulated financial capital the state’s scope for crisis management is severely limited does not stop them trying - as the part played by the major central banks in the ongoing subprime crisis clearly shows. (See “Re-reading Marx in the Light of the Sub-prime Crisis” in this issue.) One way or another all the major central banks have stepped in to try and maintain confidence and avert a bigger financial meltdown by “guaranteeing” undisclosed amounts of debt either directly (as in the case of Northern Rock) or indirectly (as in the case of the new-born offspring of the Fed which is now accepting dodgy mortgages and much else as collateral in order to lend out dollars to stricken financial companies)1.

This is tantamount to printing money and the first consequence of this is currency devaluation and inflation. The standard response of central banks to the threat of inflation ought to be to increase interest rates. On the other hand, in a situation like the present, where paralysis in the credit markets threatens to stymie new investment, then the banks’ response would normally be to lower interest rates in order to spur economic growth.

Yet, even while capital’s crisis managers worry about the prospect of stagflation - rising inflation coupled with declining economic growth - and dither about whether to increase or lower interest rates, workers know from their own experience that the cost of living is rising at an accelerating pace. Already a swathe of strikes by public sector workers facing job cuts and below-inflation pay rises mean - as the Financial Times uneasily reported in February that,

The number of days lost through industrial action topped 1m last year for only the second time in a decade...” [FT, 12th February 2008].

Once again the Keynesian ploy of awarding workers a nominal wage increase that is below the rate of inflation is being recognised for what it is: a real wage cut. In his General Theory Keynes calculated that workers would not resist cuts in the real value of their wages that receiving a nominal pay rise in a currency that was losing value entailed, unless those cuts “proceeded to an extreme degree”. This is what happened in the 1970s and 1980s and what the government and official overseers of the economy are afraid is about to happen again.

They certainly deserve to be worried. As the response by public sector workers is beginning to show, workers are no longer accepting the official inflation figures or being taken in by the smokescreen that surrounds them. For example, an “underlying inflation rate” that excludes mortgage payments was always a nonsense, but, during the house price boom, so long as “homeowners” could negotiate low fixed rate mortgages, use their house as a rising capital asset to borrow against and generally act under the illusion that even a mortgaged house is security for the future, the concept went unchallenged. Today, with the prospect of declining house prices and higher mortgage repayments any calculation of inflation which does not include mortgage repayments is worthless.

Even more cynical is the bandying about of the term “core inflation” which, despite the nitty gritty ring to the words, is officially defined as “inflation excluding food and energy costs”! With arguably two of the most basic costs of human existence removed, this is what the US Federal Reserve uses as its indicator of inflation. Although the UK’s Monetary Policy Committee prefers to go by “headline inflation” the US notion of “core inflation” is also being adopted here and in the EU, no doubt to use in official communiqués such as one reported recently by the Financial Times under the headline “Inflation Rise Smaller than Expected” [13th February 2008]. According to this report “core inflation” in the UK stood officially at 1.3% in January, “the lowest since mid- 2006”. A reassuring figure, but not very convincing.

The biggest con of all, however, is the so-called Consumer Prices Index (CPI), which stood at 2.2% in January, according to the Office of National Statistics (ONS). The CPI should not be confused with the RPI - the Retail Price Index, or prices “at the factory gates” - which the ONS announced was 4.1% in January although the British Retail Consortium’s estimate was 5.7%. While the unions want the RPI to be the basis of pay negotiations, the official yardstick for setting against public sector pay claims is the CPI. It is according to this index that the policies of the Bank of England are supposedly geared to keep inflation at no more than 2% . In any case, the governor of the Bank is charged with responsibility to stop inflation from rising beyond an annual rate of 3%. If he fails, then he must write a letter of explanation to the Chancellor of the Exchequer. The significance of Mervyn King being obliged to dispatch a letter to Alistair Darling in the “fight against inflation” might escape some of us, but worthy papers such as The Times clearly regard it as a serious matter.

On 13th February, for example, it pointed out:

In April last year, Mr King became the first Governor, since the Bank gained independence in 1997, who was forced to write a letter of explanation to the Chancellor, who was Gordon Brown at the time, detailing why CPI inflation had reached 3.1 per cent.

And went on to add, Mr King said:

Over the next couple of years, it is odds-on I will have to write another letter. I can’t be entirely sure in which direction. It is rather more likely than not.

The fact that the Governor of the Bank of England appears to think that people will believe there is an “odds on” chance of inflation going beyond 3% when it is already palpably far beyond that, speaks volumes about how far the powers that be are used to manipulating public opinion by their official communiqués and statistics which have little bearing on reality.

However, for the government and the Bank of England, it is important on two counts that the mythical inflation figures are maintained - on the one hand to forestall higher pay claims for as long as possible and on the other to give the Bank leeway to cut interest rates (as it did in January) when it sees the credit crisis as a bigger priority than inflation.

Food and Fuel: The Burning Issues

But the gap between myth and reality is rapidly widening and the CPI figures are losing all credibility. The January figures, for example, did not even include the recent domestic gas and electricity increases of 10-15 per cent while the acknowledged “upward effect” from food is put down “particularly (to) fruit, such as grapes and grapefruit, where prices fell by less than last year”.2 While the cost of fresh grapes and grapefruit is clearly important for anyone trying to follow a healthy lifestyle, the average British household is more likely to be concerned with the price of more traditional staples such as bread, milk, meat and eggs, all of which are going up month by month. However the official figures try to disguise it, food price inflation is no longer a marginal issue for the working class, even in the consumer heartlands of capitalism where food represents a smaller share of the household budget than in the past.

Under capitalism, when the “global demand for agricultural raw materials outstrips supply” (Financial Times) there is only one outcome: prices go up. So, throughout the world food protests are becoming more frequent. Last year Mexican workers took to the streets to protest against the steep rise in the price of maize, their staple grain.

This year in January thousands demonstrated in Jakarta, the capital of Indonesia, against a 50% rise in one month (125% over the past year) of the price of soyabeans, an essential ingredient and source of protein throughout east Asia.

Packaged rice prices are soaring as India and China have restricted rice exports for fear of similar protests there. Last year, several important grain exporting countries imposed export tariffs on key crops, including wheat by Canada and Ukraine (world’s fifth largest wheat exporter) while already this year the price of best quality wheat used in bread surged to an all-time high. At the same time wheat, stocks in the USA, the world’s largest exporter, are set to reach a sixty-year low. Already by February agricultural commodities are trading on average at 15 per cent higher than last year.

As usual, the first response of the capitalists is to blame the working class: this time in China and, as an after-thought, India - for changing their diet and eating more pork (the pigs are fed on grain) and bread. But, as one commentator at any rate is prepared to acknowledge,

China’s per capita consumption of meat had already caught up with western levels by 2005, well before global food prices took off. Instead, the recent strength of global food prices largely reflects temporary supply-side disruptions and the diversion of crops to biofuels ...(3)

Precisely. For a more convincing explanation of the steady rise in global food prices than that some of the world’s poorest workers are eating better we have to look at global warming and the capitalist response to it.

On the one hand, freak weather conditions associated with climate change (exceptional and prolonged drought in Australia, floods in rice-growing areas) have contributed to supply shortfalls. On the other, capitalism’s current obsession with promoting and subsidising the production of biofuels as an alternative to oil (where combating global warming has become synonymous with energy security for the major powers, as if the two goals were the same) has not only encouraged the diversion of agricultural land from food to fuel crops, it has led to many existing food crops being sold for fuel rather than food.

For example maize (especially in the US and China) and, to a lesser extent, wheat (in Germany, Spain and France) are being used to produce ethanol. As for soyabeans, not only are they being diverted to produce biodiesel, many growers in the US and Latin America are stopping growing soya in favour of sugar cane for the ethanol market.

The net effect is what we see now: food shortages and exceptionally high prices.

Cashing in on it all are the speculators, gambling on future commodity prices and unconcerned about the prospect of more and more people being unable to afford the very basics of life.

For the central banks and whoever else is attempting to manage the inflationary consequences of the so-called credit crunch the worldwide escalation of food prices compounds their problem. But these people are more than well paid and do not need to worry. For millions living on the margins of existence food price rises can mean literally the difference between life and death. For the working class everywhere the rising cost of food and fuel is no longer a marginal issue. It is going to take more than a letter to the Chancellor for the Bank of England’s inflation targets to be taken seriously again.

ER(1) Known as the Term Auction Facility, or TAM, this little known body had quietly lent out $50bn from Fed funds in short-term loans to US banks “against all sort of dodgy collateral. The banks are increasingly giving the Fed the garbage collateral nobody else want to take”. Information and quote from a financial analyst in Financial Times 19th February 2008.

(2) Office of National Statistics web communiqué, 12th February 2008.

(3) Julian Jessop “View of the Day” in Financial Times 30th January 2008.

Revolutionary Perspectives

Journal of the Communist Workers’ Organisation -- Why not subscribe to get the articles whilst they are still current and help the struggle for a society free from exploitation, war and misery? Joint subscriptions to Revolutionary Perspectives (3 issues) and Aurora (our agitational bulletin - 4 issues) are £15 in the UK, €24 in Europe and $30 in the rest of the World.

Revolutionary Perspectives #45

Spring 2008 (Series 3)

Start here...

- Navigating the Basics

- Platform

- For Communism

- Introduction to Our History

- CWO Social Media

- IWG Social Media

- Klasbatalo Social Media

- Italian Communist Left

- Russian Communist Left

The Internationalist Communist Tendency consists of (unsurprisingly!) not-for-profit organisations. We have no so-called “professional revolutionaries”, nor paid officials. Our sole funding comes from the subscriptions and donations of members and supporters. Anyone wishing to donate can now do so safely using the Paypal buttons below.

ICT publications are not copyrighted and we only ask that those who reproduce them acknowledge the original source (author and website leftcom.org). Purchasing any of the publications listed (see catalogue) can be done in two ways:

- By emailing us at uk@leftcom.org, us@leftcom.org or ca@leftcom.org and asking for our banking details

- By donating the cost of the publications required via Paypal using the “Donate” buttons

The CWO also offers subscriptions to Revolutionary Perspectives (3 issues) and Aurora (at least 4 issues):

- UK £15 (€18)

- Europe £20 (€24)

- World £25 (€30, $30)

Take out a supporter’s sub by adding £10 (€12) to each sum. This will give you priority mailings of Aurora and other free pamphlets as they are produced.

ICT sections

Basics

- Bourgeois revolution

- Competition and monopoly

- Core and peripheral countries

- Crisis

- Decadence

- Democracy and dictatorship

- Exploitation and accumulation

- Factory and territory groups

- Financialization

- Globalization

- Historical materialism

- Imperialism

- Our Intervention

- Party and class

- Proletarian revolution

- Seigniorage

- Social classes

- Socialism and communism

- State

- State capitalism

- War economics

Facts

- Activities

- Arms

- Automotive industry

- Books, art and culture

- Commerce

- Communications

- Conflicts

- Contracts and wages

- Corporate trends

- Criminal activities

- Disasters

- Discriminations

- Discussions

- Drugs and dependencies

- Economic policies

- Education and youth

- Elections and polls

- Energy, oil and fuels

- Environment and resources

- Financial market

- Food

- Health and social assistance

- Housing

- Information and media

- International relations

- Law

- Migrations

- Pensions and benefits

- Philosophy and religion

- Repression and control

- Science and technics

- Social unrest

- Terrorist outrages

- Transports

- Unemployment and precarity

- Workers' conditions and struggles

History

- 01. Prehistory

- 02. Ancient History

- 03. Middle Ages

- 04. Modern History

- 1800: Industrial Revolution

- 1900s

- 1910s

- 1911-12: Turko-Italian War for Libya

- 1912: Intransigent Revolutionary Fraction of the PSI

- 1912: Republic of China

- 1913: Fordism (assembly line)

- 1914-18: World War I

- 1917: Russian Revolution

- 1918: Abstentionist Communist Fraction of the PSI

- 1918: German Revolution

- 1919-20: Biennio Rosso in Italy

- 1919-43: Third International

- 1919: Hungarian Revolution

- 1930s

- 1931: Japan occupies Manchuria

- 1933-43: New Deal

- 1933-45: Nazism

- 1934: Long March of Chinese communists

- 1934: Miners' uprising in Asturias

- 1934: Workers' uprising in "Red Vienna"

- 1935-36: Italian Army Invades Ethiopia

- 1936-38: Great Purge

- 1936-39: Spanish Civil War

- 1937: International Bureau of Fractions of the Communist Left

- 1938: Fourth International

- 1940s

- 1960s

- 1980s

- 1979-89: Soviet war in Afghanistan

- 1980-88: Iran-Iraq War

- 1980: Strikes in Poland

- 1982: First Lebanon War

- 1982: Sabra and Chatila

- 1986: Chernobyl disaster

- 1987-93: First Intifada

- 1989: Fall of the Berlin Wall

- 1979-90: Thatcher Government

- 1982: Falklands War

- 1983: Foundation of IBRP

- 1984-85: UK Miners' Strike

- 1987: Perestroika

- 1989: Tiananmen Square Protests

- 1990s

- 1991: Breakup of Yugoslavia

- 1991: Dissolution of Soviet Union

- 1991: First Gulf War

- 1992-95: UN intervention in Somalia

- 1994-96: First Chechen War

- 1994: Genocide in Rwanda

- 1999-2000: Second Chechen War

- 1999: Introduction of euro

- 1999: Kosovo War

- 1999: WTO conference in Seattle

- 1995: NATO Bombing in Bosnia

- 2000s

- 2000: Second intifada

- 2001: September 11 attacks

- 2001: Piqueteros Movement in Argentina

- 2001: War in Afghanistan

- 2001: G8 Summit in Genoa

- 2003: Second Gulf War

- 2004: Asian Tsunami

- 2004: Madrid train bombings

- 2005: Banlieue riots in France

- 2005: Hurricane Katrina

- 2005: London bombings

- 2006: Anti-CPE movement in France

- 2006: Comuna de Oaxaca

- 2006: Second Lebanon War

- 2007: Subprime Crisis

- 2008: Onda movement in Italy

- 2008: War in Georgia

- 2008: Riots in Greece

- 2008: Pomigliano Struggle

- 2008: Global Crisis

- 2008: Automotive Crisis

- 2009: Post-election crisis in Iran

- 2009: Israel-Gaza conflict

- 2020s

- 1920s

- 1921-28: New Economic Policy

- 1921: Communist Party of Italy

- 1921: Kronstadt Rebellion

- 1922-45: Fascism

- 1922-52: Stalin is General Secretary of PCUS

- 1925-27: Canton and Shanghai revolt

- 1925: Comitato d'Intesa

- 1926: General strike in Britain

- 1926: Lyons Congress of PCd’I

- 1927: Vienna revolt

- 1928: First five-year plan

- 1928: Left Fraction of the PCd'I

- 1929: Great Depression

- 1950s

- 1970s

- 1969-80: Anni di piombo in Italy

- 1971: End of the Bretton Woods System

- 1971: Microprocessor

- 1973: Pinochet's military junta in Chile

- 1975: Toyotism (just-in-time)

- 1977-81: International Conferences Convoked by PCInt

- 1977: '77 movement

- 1978: Economic Reforms in China

- 1978: Islamic Revolution in Iran

- 1978: South Lebanon conflict

- 2010s

- 2010: Greek debt crisis

- 2011: War in Libya

- 2011: Indignados and Occupy movements

- 2011: Sovereign debt crisis

- 2011: Tsunami and Nuclear Disaster in Japan

- 2011: Uprising in Maghreb

- 2014: Euromaidan

- 2016: Brexit Referendum

- 2017: Catalan Referendum

- 2019: Maquiladoras Struggle

- 2010: Student Protests in UK and Italy

- 2011: War in Syria

- 2013: Black Lives Matter Movement

- 2014: Military Intervention Against ISIS

- 2015: Refugee Crisis

- 2018: Haft Tappeh Struggle

- 2018: Climate Movement

People

- Amadeo Bordiga

- Anton Pannekoek

- Antonio Gramsci

- Arrigo Cervetto

- Bruno Fortichiari

- Bruno Maffi

- Celso Beltrami

- Davide Casartelli

- Errico Malatesta

- Fabio Damen

- Fausto Atti

- Franco Migliaccio

- Franz Mehring

- Friedrich Engels

- Giorgio Paolucci

- Guido Torricelli

- Heinz Langerhans

- Helmut Wagner

- Henryk Grossmann

- Karl Korsch

- Karl Liebknecht

- Karl Marx

- Leon Trotsky

- Lorenzo Procopio

- Mario Acquaviva

- Mauro jr. Stefanini

- Michail Bakunin

- Onorato Damen

- Ottorino Perrone (Vercesi)

- Paul Mattick

- Rosa Luxemburg

- Vladimir Lenin

Politics

- Anarchism

- Anti-Americanism

- Anti-Globalization Movement

- Antifascism and United Front

- Antiracism

- Armed Struggle

- Autonomism and Workerism

- Base Unionism

- Bordigism

- Communist Left Inspired

- Cooperativism and autogestion

- DeLeonism

- Environmentalism

- Fascism

- Feminism

- German-Dutch Communist Left

- Gramscism

- ICC and French Communist Left

- Islamism

- Italian Communist Left

- Leninism

- Liberism

- Luxemburgism

- Maoism

- Marxism

- National Liberation Movements

- Nationalism

- No War But The Class War

- PCInt-ICT

- Pacifism

- Parliamentary Center-Right

- Parliamentary Left and Reformism

- Peasant movement

- Revolutionary Unionism

- Russian Communist Left

- Situationism

- Stalinism

- Statism and Keynesism

- Student Movement

- Titoism

- Trotskyism

- Unionism

Regions

User login

This work is licensed under a Creative Commons Attribution 3.0 Unported License.