You are here

Home ›The Turner Plan - Its Time to Pension Off Capitalism

Capitalism is in crisis and for thirty years they have tried to make us pay for it. First they destroyed our wages with inflation, then they destroyed our jobs through restructuring and then they increased our exploitation in the drive for productivity. And still this is not enough: Now they want to deny us a right to even a minimum standard of living in retirement.

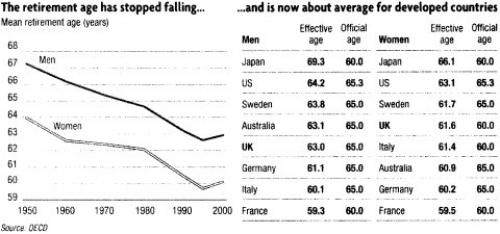

This is not, of course how our capitalists present the crisis. Really, they say, the system is a victim of its own success. The standard of living is so good that we are now all living too long and so the “generous” pension schemes of the past can no longer be supported as too few current workers will have to support too many living on pensions. They also state that the retirement age is falling in real terms because people are taking “generous pensions” early. All these are lies on several counts. Let’s take the question of real retirement ages. Its true they have been falling as many older workers have been driven from work (as being too expensive). However this only brings real retirement in Britain into line with something like that of the rest of the EU, as the table from the Financial Times below shows. The same table also shows that even this has halted and retirement ages are being pushed back up as more workers have lost their pensions through various capitalist frauds and now have to work longer (see below).

If we then take the demographic argument, it is true that the number of pensioners will rise by about 50% from around 11 million to 17 million by 2050. However pensioners are not the only non-working group in society and as the number of pensioners rise so the number (for example) in school-age children will decline. Even according to the state’s own projections nothing will change between now and 2050 in that about 28 million employed workers will support about 32 million “others”. It is also true that at current levels, if no change is made to the state pension scheme then spending on pensions (again according to official projections) will rise from about 6.2% to 7.5% of GDP (1). As the European average is already at 11% this hardly represents a crisis. So why have the bosses been moaning about the cost of pensions. Why have many workers lost their pensions rights and why has the government set up a Pensions Commission under former CBI boss Adair (now Lord) Turner?

The Real Crisis

The fact is that this is all part of the attack on working class living standards which has been going on in every country since the world economic crisis first erupted at the start of the 1970s. This crisis is a consequence of the law of the tendency of the rate of profit to fall. It does not mean that the capitalists stop making profits but it does mean that their average profit rates are so low that they are unable collectively to expand in the manner they did during the post war boom in the 1950s and 1960s. Not surprisingly, pensions are seen as an unnecessary overhead by bosses, who would prefer it if we all either dropped dead the minute we were no longer useful or went into the workhouse to die as Linden did in Robert Tressell’s novel, The Ragged-Trousered Philanthropists (1910). In fact what has really been going on has been little short of theft. Last year we described some of it like this:

In Britain the theft of private pensions by companies has been going on for years, not just through well-publicised scandals like that of Maxwell and Daily Mirror workers, but through the systematic plundering of pension funds to cover the fall in profits faced by industries as a result of the deepening of the capitalist crisis. Throughout the 1990s many companies stopped making contributions to occupational schemes and so saved themselves an estimated £18 billions. Naturally enough they didn’t tell staff they had taken a so-called “pensions holiday” believing a strong stock market would cover their theft. Workers continued to make their payments into the fund, discovering the fraud when the companies ditched their final salary schemes after the collapse of the stock market. Companies such as Unilever went further and transferred the pension fund (to the company balance sheet) and took it as profit. Since 1992 Unilever has taken £1,2 billions from the pension fund and handed two-thirds of it to shareholders as dividends. Until recently, scandals such as these were blamed on greedy companies or the fall in the stock market.

Pensions Under Attack in Revolutionary Perspectives 35

All this is perfectly legal since it is often the directors of the company who are the trustees of the pension scheme who are only bound by the rules of the scheme and not by any legal restrictions. As we demonstrated a couple of years ago (in Revolutionary Perspectives 29) it is not unknown for these trustees to give themselves a rich payout and then close the scheme, putting their employees remaining money in a new, and less remunerative, scheme.

Since then the robbery of private pension schemes has become more extensive. Many big companies have dropped final salary schemes (where your pension is based on the wages you earn in your final year of work) and replaced them by average earnings schemes (which bases your pension on your average salary over your working life). This means a dramatic drop in pensions for all but the very highest earners. In 1997 only 10% of companies closed their final salary scheme to new members but last year this had reached 57%, including the Co-op. Other firms like Arcadia want their workers to increase contributions from 4% to 6 % and to increase the age of retirement. (2) However the most chilling move came from Rentokil Initial group which, just before Christmas, presented their workers with the news that not only new, but also existing employees, would have their final salary pension scheme wound up and replaced with a “defined contributions” scheme. This depends on how well the fund you pay into performs on the stock market. Welcome to the contributions casino! According to the National Association of Pension Funds among companies listed on the FTSE 100 alone there is a pension deficit of £40 billions. (3)

With company pension schemes in such a mess why should the Turner Plan (which ostensibly focuses on the state retirement scheme) be a useful diversion for our private bosses? In the first place it repeats the lie that the pensions crisis is a demographic one. It ignores the corruption, the mis-selling scandals, the outright robbery, the mismanagement of funds when the stock market was booming. These are all the consequences of the profits crisis of capitalism which you would not expect a former director of the CBI to highlight. In the second place it offers to create a state system which is slightly more generous and which bosses can then opt into. It would allow many of them to wind down or abandon their own schemes and thus pay less to maintain a pension fund (and yet still say they were meeting their obligations). This is why some bosses organisations like the European Engineering Federation have welcomed it. Others, like Sir Digby Jones of the CBI, have called the Plan “the most serious proposals for pension reform yet” but at the same time have criticised it as a “tax on jobs”. Apart from being untrue (as we showed above Britain would still have a contribution rate at just over half the European average and labour costs would only rise by 0.6%) this criticism is useful since if the CBI opposes it many workers might think it acceptable. The Turner Plan is indeed a model of ruling class cleverness (he is not a Lord of the Realm for nothing). The retirement age is set to rise to 69 by 2050 but not for while. No change is envisaged before 2030 (when it would begin to rise by a year every five years). This means that nobody 50 or over will be affected, those over 40 would have one year added to retiring age whilst those who will be worst hit have not even entered the labour force yet. The calculation is that this will weaken opposition. Employers and their Conservative Party supporters however, have also used the pensions debate to question the deal between the Government and public sector workers unions which would allow state workers to retire at 60. They argue that it is unfair for people like classroom assistants to retire at 60 whilst industrial workers would retire at 69. It is unfair but the answer is not for everyone to work longer but for everyone to have the right to retire at 60. The only reason capitalism cannot grant this is because it would undermine their whole plan which is to make us pay more, work longer and die quicker so that pension payments are cut.

The Real Pensions Crisis

The real crisis is the poverty of so many pensioners today.

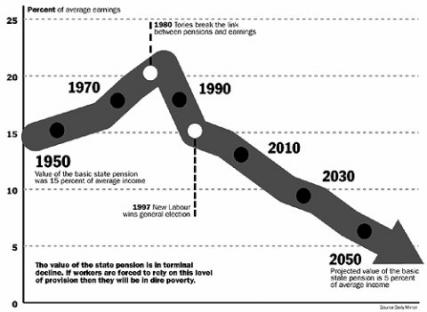

According to the National Pensions Convention there are 4 million pensioners living below the poverty line (the Government admits to 2 millions). They are concealing the fact that there are 2 million more pensioners in poverty than the statistics show. The reason they are so poor is made clear below by the graph from the Daily Mirror.

When the current pensions scheme was introduced as part of the Beveridge reforms (4) under the 1945-51 Labour Government they were intended to be only a guarantee of basic “subsistence”. However, as the accumulation cycle of capitalism was in an upturn during the 1950s, and 1960s, pensions were increased. By the early 1970s they were over 20% of average earnings. However this was also when the crisis hit and the first response of the state was to print more money to solve the crisis. This only created inflation. As workers then fought and won higher wages, pensions also went up until the Thatcher victory in 1980. As one of the first cost-cutting measures of the new regime the link between earnings and pensions was broken. The real value of pensions has been falling ever since, and both Tory and Labour Governments have made further cuts in pension provision for ordinary workers. The real value is back where it was in 1950 at 16% of average earnings.

A second pension system set up under Labour in the 1970s called SERPS was gradually cut and Norman Fowler then allowed people to opt out so that they could buy personal pensions from the insurance industry. This has led those on low incomes to be robbed blind and to several financial scandals as these insurance firms mis-sold pensions by promising returns which were either totally unrealistic or not even worth the amount that was paid in. (5) In fact, as we wrote in RP35, all ideas by both Labour and Tories for anything other than the declining state pension have been about helping the rich. Half of the current state spending on pensions is on tax relief for private pensions for the wealthier segments of society. If we add that women will have to have their retirement age raised by 2008 (EU directive) and that the current Government wants to exclude overtime payments and weekend pay from pension contribution calculations then we can see that the situation can only get worse even if the Turner Plan is adopted. So far the only response of the Government is to say that they are worried about the costs which can mean only that they think Turner is too generous. Brown introduced Pension Credit in 2003. This is a complicated means tested benefit which not all the officers of the Department of Works and Pensions understand. About 2 million pensioners who are entitled to it don’t get it mainly because they have to apply for it and cannot understand it or don’t know how to. For Brown it is cost-effective (it obviously saves lots of money if people don’t apply for it) and thus he is suspicious that the Turner plan will cost too much if it guarantees at least part of a pension for all.

Pensions and the State

A civilised society is one which looks after all its citizens, particularly those who are most vulnerable. But as Marx revealed a century and half ago capitalism doesn’t deal in sentimental abstractions like “care” and “community”. Only the cash nexus rules in capitalist relations. Indeed some may even be asking why capitalism conceded pensions to us in the first place. Well, it wasn’t due to a coup by Help the Aged. It was much more to do with the needs of imperialist war and the exigencies of the class struggle.

The first state pension scheme was not brought in by the Labour Government in Britain in 1945 but by a Prussian militarist who believed only in autocratic government. Otto von Bismarck is credited with being the founder of modern Germany in 1871. 1871 was also the year of the Paris Commune which he played a role in suppressing by allowing the French prisoners of war to return home to fight for the reactionary monarchist government of Thiers. Bismarck was terrified, not only by the Commune, but also by the appearance of the First International which was believed by the ruling class to be behind the Commune. The International was actually on the point of dissolution, but Bismarck did not know this, and when a Socialist Party was founded in Germany in 1875 he was terrified that class struggle would tear apart his newly created German Reich. After a madman unsuccessfully attempted to assassinate Kaiser Wilhelm I in 1878 Bismarck used it as an excuse to ban the Socialist Party. He could not however arrest the Socialist MPs who enjoyed parliamentary immunity and the Socialist Party despite not having a legal presence began to grow amongst the working class so that at each election the number of Socialist MPs grew. In 1884 Bismarck therefore tried another tack. He tried to win the workers away from socialism by stressing the protecting role of the state. He made his motives clear in the Reichstag:

That the state should concern itself with those of its citizens who need help to a greater degree than hitherto ... is a conservative policy which has as its goal to encourage the view among the unpropertied classes ... that the state is not only a necessary institution but also a beneficent one.

He stated that he did not care if his opponents called it “socialism” but that its aim was to “deal with social democratic excess”.

Give the working-man the right to work as long as he is healthy; assure him care when he is sick; assure him maintenance when he is old. If you do that, and do not fear the sacrifice - or cry out “State Socialism” (as soon as) the words “Provision for old age” are uttered, - if the State will show a little more Christian solicitude for the working-man, then I believe that the gentlemen of the Wyden Program (the socialist program of the Social-Democratic Party) will sound their bird-call in vain, and that thronging to them will cease as soon as the workingmen see that the Government and legislative bodies are earnestly concerned for their welfare...

Welfare and Warfare

Bismarck’s scheme was no more generous than later ones in that it was for workers over 70 at a time when the average age of death was below 50. It became a model for others to follow. In the build-up to the First World War, the first global imperialist war of the modern age, the British also worried about the growing class struggle as strikes mounted. The most clear-sighted defenders of the British Empire, Lloyd-George and Churchill both recognised that preparations for war were necessary. The answer was the so-called People’s Budget of 1909 in which state pensions and a very limited national insurance scheme for some workers was introduced. Like Bismarck’s proposal, the 5/- a week (when the basic wage was about 21/-) (6) for those over 70 was hardly generous, and not costly, but it did provide a figleaf for the real aim of the People’s Budget. This was a massive increase in taxation to pay for the building of 8 Dreadnoughts for the coming war. Both the German and British schemes had the same purpose. They aimed to demonstrate that the imperialist state looks after everyone and that social solidarity is not incompatible with fighting for the ruling class. Hitler,who did not call his party “National Socialist” by accident, noticed this and praised Bismarck’s scheme in Mein Kampf as creating the ideal volkisch (populist) base for mobilising the population behind his own war plans. (7)

Pensions therefore are not the generous offer of a civilised society. In the first place they are not generous because we pay for them. In the second place they only exist because the ruling class fears the working class would turn to their own solution if they did not exist. Instead of social solidarity, pensions in their present form are designed to create national unity across classes. If the welfare state in general, and pensions in particular, are just another ruling class trick to get us to identify with the bourgeois nation, does this mean that we should ignore the fight to stop the cuts in pensions? Certainly not. As Marx quite clearly stated in Wages Prices and Profits any class which did not fight would:

By cowardly giving way in their everyday conflict with capital ... certainly disqualify itself from initiating any larger movement.

From Marx-Engels Selected Works in One Volume p.225

The fight to defend pensions is no different from the fight to defend any other aspect of our daily lives. The only reason pensions are under attack now is because the capitalists have succeeded in the last twenty years in making us pay for the crisis in lost jobs and wage cuts. With cuts in the social wage coming via the dismantling of free health care and the social security system, pensions are the last area to be attacked. However Marx also warned that if we simply fight to defend ourselves from the attacks of capitalism, and exaggerate the permanence of each victory, we would in the long run always lose, since we would only be fighting the symptom of the disease and not the cause, which is the system of exploitation itself.

How to Fight?

In the last couple of years workers in many of the main capitalist countries have shown us how to fight. In 1995 in France the so-called Juppe Plan aimed to make massive cuts in the social state but this led to a huge wave of strikes and Juppe went. Instead the French state bided its time and in 2003 decided to make its attack section by section and is achieving greater success.

This will be the pattern of the bosses’ attacks. Divide the workers section by section and they can be defeated. This was how they defeated us in the 1980s when they wanted to push through restructuring. As we have already seen the Turner Plan counts on being accepted as the least worst option by workers as it is future workers who will suffer the most under its proposals. By the same token employers are hoping to divide the working class between private and public workers. Aiding and abetting all this will be the unions whose own officials’ wages and pensions are paid by ordinary members. What the unions will do we saw last year. Having called a one day strike for last March (the usual token effort) and then made sure that health workers were not balloted, so they could not legally take part, the unions called off the strike at the last minute, claiming that the attacks on pensions had been withdrawn. And so they were until after the Labour Party was re-elected. Now public sector workers, civil servants, teachers and others, those who work on low paid public sector jobs, are facing draconian cuts in pension rights once again. But this year we did not even get the promise of a one day strike, only a TUC day of action on February 18th instead. This feeble response is no surprise since TUC, supports the Turner Plan. Its General Secretary, Brendan Barber told the Financial Times that:

The clear majority of the conclusions are progressive and meet the tests we set in advance.

But then his pension scheme is safe! This union feebleness was also visible at Scottish Power. At the start of this year Scottish Power said existing workers had to contribute 2% more of their pay to the pensions scheme and new workers would have to retire at 65 not 63 as at present. This would have been a robbery of another £150 millions from the workforce. Amicus leaders accepted the framework of these demands and just thought that the only thing that could be achieved was some discussion over details. Ordinary workers however were angry and put pressure on their shop stewards to demand a strike ballot. This idea was also taken up by other Scottish Power workers in unions like Prospect and Unison. Given even this threat of united action Scottish Power backed down and came up with new proposals which mean that those on the current scheme retain their rights. New workers will have to join a money purchase scheme but after 10 years they can move to the final salary scheme. The message is clear. The bosses hope to divide us section by section, age group by age group, employment status by employment status and union by union (and the unions will assist them in this). Only the most widespread unity and solidarity can fight back.

The Real Defence of Pensions

At the moment public sector workers all face new attacks but they are all timed differently. Local government workers in England and Wales have since last year faced an abandonment of the “the rule of 85” (your age plus your years worked add up to 85) which means they cannot claim a full pension until 65 and they will lose 30% of the former pension if they retire at 60 (see article on trades unions in this issue).

The same threat hangs over Scottish local government workers this year. Civil servants face the same rise in retirement age but not until 2013 (so over 52s won’t be affected). The same thing is planned for teachers and lecturers. Lower paid workers doing manual jobs for local authorities face an increase in contributions of 6-7% and they will find that overtime will be excluded from any calculations. Fighting singly these groups are unlikely to win but fighting together then they have a greater chance of success. However even here the public sector workers need to demonstrate to all workers that they are heading the fight for pensions in both private and public sector.

At the end of the day we should also ask ourselves what kind of society is this miracle called capitalism. Millions in the south of the planet will die of malnutrition and war as a direct consequence of the system’s greed and now it cannot even guarantee a decent retirement for those who given their labour all their lives. The fight for pensions should also raise the spectre of a fight for a better society where work is not an alienating form of exploitation but a positive contribution by each member of society to the collective community. The principle “From each according to ability, to each according to need” is the basis of a sane society. This capitalism certainly isn’t. Its time we pensioned it off.

AD(1) According to the Pensions Commission, see the Financial Times December 1 2005

(2) The Financial Times January 7/8 2006

(3) The Financial Times December 23 2005

(4) The Beveridge Report was finished in 1942 calling for a universal but very basic pension provision which was to be paid for by national insurance contributions.

(5) It is the insurance business that is screaming loudest against Turner since he aims to cut them out from the new scheme on the grounds of their past history for robbing their clients. After first denouncing the Report they are now arguing that they can do the job just as cheaply as the state scheme!

(6) -

(7) The roots of the identification of statism with socialism in German Social Democracy will be examined in our next issue.

Revolutionary Perspectives

Journal of the Communist Workers’ Organisation -- Why not subscribe to get the articles whilst they are still current and help the struggle for a society free from exploitation, war and misery? Joint subscriptions to Revolutionary Perspectives (3 issues) and Aurora (our agitational bulletin - 4 issues) are £15 in the UK, €24 in Europe and $30 in the rest of the World.

Revolutionary Perspectives #38

Spring 2006 (Series 3)

Start here...

- Navigating the Basics

- Platform

- For Communism

- Introduction to Our History

- CWO Social Media

- IWG Social Media

- Klasbatalo Social Media

- Italian Communist Left

- Russian Communist Left

The Internationalist Communist Tendency consists of (unsurprisingly!) not-for-profit organisations. We have no so-called “professional revolutionaries”, nor paid officials. Our sole funding comes from the subscriptions and donations of members and supporters. Anyone wishing to donate can now do so safely using the Paypal buttons below.

ICT publications are not copyrighted and we only ask that those who reproduce them acknowledge the original source (author and website leftcom.org). Purchasing any of the publications listed (see catalogue) can be done in two ways:

- By emailing us at uk@leftcom.org, us@leftcom.org or ca@leftcom.org and asking for our banking details

- By donating the cost of the publications required via Paypal using the “Donate” buttons

- By cheque made out to "Prometheus Publications" and sending it to the following address: CWO, BM CWO, London, WC1N 3XX

The CWO also offers subscriptions to Revolutionary Perspectives (3 issues) and Aurora (at least 4 issues):

- UK £15 (€18)

- Europe £20 (€24)

- World £25 (€30, $30)

Take out a supporter’s sub by adding £10 (€12) to each sum. This will give you priority mailings of Aurora and other free pamphlets as they are produced.

ICT sections

Basics

- Bourgeois revolution

- Competition and monopoly

- Core and peripheral countries

- Crisis

- Decadence

- Democracy and dictatorship

- Exploitation and accumulation

- Factory and territory groups

- Financialization

- Globalization

- Historical materialism

- Imperialism

- Our Intervention

- Party and class

- Proletarian revolution

- Seigniorage

- Social classes

- Socialism and communism

- State

- State capitalism

- War economics

Facts

- Activities

- Arms

- Automotive industry

- Books, art and culture

- Commerce

- Communications

- Conflicts

- Contracts and wages

- Corporate trends

- Criminal activities

- Disasters

- Discriminations

- Discussions

- Drugs and dependencies

- Economic policies

- Education and youth

- Elections and polls

- Energy, oil and fuels

- Environment and resources

- Financial market

- Food

- Health and social assistance

- Housing

- Information and media

- International relations

- Law

- Migrations

- Pensions and benefits

- Philosophy and religion

- Repression and control

- Science and technics

- Social unrest

- Terrorist outrages

- Transports

- Unemployment and precarity

- Workers' conditions and struggles

History

- 01. Prehistory

- 02. Ancient History

- 03. Middle Ages

- 04. Modern History

- 1800: Industrial Revolution

- 1900s

- 1910s

- 1911-12: Turko-Italian War for Libya

- 1912: Intransigent Revolutionary Fraction of the PSI

- 1912: Republic of China

- 1913: Fordism (assembly line)

- 1914-18: World War I

- 1917: Russian Revolution

- 1918: Abstentionist Communist Fraction of the PSI

- 1918: German Revolution

- 1919-20: Biennio Rosso in Italy

- 1919-43: Third International

- 1919: Hungarian Revolution

- 1930s

- 1931: Japan occupies Manchuria

- 1933-43: New Deal

- 1933-45: Nazism

- 1934: Long March of Chinese communists

- 1934: Miners' uprising in Asturias

- 1934: Workers' uprising in "Red Vienna"

- 1935-36: Italian Army Invades Ethiopia

- 1936-38: Great Purge

- 1936-39: Spanish Civil War

- 1937: International Bureau of Fractions of the Communist Left

- 1938: Fourth International

- 1940s

- 1960s

- 1980s

- 1979-89: Soviet war in Afghanistan

- 1980-88: Iran-Iraq War

- 1982: First Lebanon War

- 1982: Sabra and Chatila

- 1986: Chernobyl disaster

- 1987-93: First Intifada

- 1989: Fall of the Berlin Wall

- 1979-90: Thatcher Government

- 1980: Strikes in Poland

- 1982: Falklands War

- 1983: Foundation of IBRP

- 1984-85: UK Miners' Strike

- 1987: Perestroika

- 1989: Tiananmen Square Protests

- 1990s

- 1991: Breakup of Yugoslavia

- 1991: Dissolution of Soviet Union

- 1991: First Gulf War

- 1992-95: UN intervention in Somalia

- 1994-96: First Chechen War

- 1994: Genocide in Rwanda

- 1999-2000: Second Chechen War

- 1999: Introduction of euro

- 1999: Kosovo War

- 1999: WTO conference in Seattle

- 1995: NATO Bombing in Bosnia

- 2000s

- 2000: Second intifada

- 2001: September 11 attacks

- 2001: Piqueteros Movement in Argentina

- 2001: War in Afghanistan

- 2001: G8 Summit in Genoa

- 2003: Second Gulf War

- 2004: Asian Tsunami

- 2004: Madrid train bombings

- 2005: Banlieue riots in France

- 2005: Hurricane Katrina

- 2005: London bombings

- 2006: Comuna de Oaxaca

- 2006: Second Lebanon War

- 2007: Subprime Crisis

- 2008: Onda movement in Italy

- 2008: War in Georgia

- 2008: Riots in Greece

- 2008: Pomigliano Struggle

- 2008: Global Crisis

- 2008: Automotive Crisis

- 2009: Post-election crisis in Iran

- 2009: Israel-Gaza conflict

- 2006: Anti-CPE Movement in France

- 2020s

- 1920s

- 1921-28: New Economic Policy

- 1921: Communist Party of Italy

- 1921: Kronstadt Rebellion

- 1922-45: Fascism

- 1922-52: Stalin is General Secretary of PCUS

- 1925-27: Canton and Shanghai revolt

- 1925: Comitato d'Intesa

- 1926: General strike in Britain

- 1926: Lyons Congress of PCd’I

- 1927: Vienna revolt

- 1928: First five-year plan

- 1928: Left Fraction of the PCd'I

- 1929: Great Depression

- 1950s

- 1970s

- 1969-80: Anni di piombo in Italy

- 1971: End of the Bretton Woods System

- 1971: Microprocessor

- 1973: Pinochet's military junta in Chile

- 1975: Toyotism (just-in-time)

- 1977-81: International Conferences Convoked by PCInt

- 1977: '77 movement

- 1978: Economic Reforms in China

- 1978: Islamic Revolution in Iran

- 1978: South Lebanon conflict

- 2010s

- 2010: Greek debt crisis

- 2011: War in Libya

- 2011: Indignados and Occupy movements

- 2011: Sovereign debt crisis

- 2011: Tsunami and Nuclear Disaster in Japan

- 2011: Uprising in Maghreb

- 2014: Euromaidan

- 2016: Brexit Referendum

- 2017: Catalan Referendum

- 2019: Maquiladoras Struggle

- 2010: Student Protests in UK and Italy

- 2011: War in Syria

- 2013: Black Lives Matter Movement

- 2014: Military Intervention Against ISIS

- 2015: Refugee Crisis

- 2018: Haft Tappeh Struggle

- 2018: Climate Movement

People

- Amadeo Bordiga

- Anton Pannekoek

- Antonio Gramsci

- Arrigo Cervetto

- Bruno Fortichiari

- Bruno Maffi

- Celso Beltrami

- Davide Casartelli

- Errico Malatesta

- Fabio Damen

- Fausto Atti

- Franco Migliaccio

- Franz Mehring

- Friedrich Engels

- Giorgio Paolucci

- Guido Torricelli

- Heinz Langerhans

- Helmut Wagner

- Henryk Grossmann

- Karl Korsch

- Karl Liebknecht

- Karl Marx

- Leon Trotsky

- Lorenzo Procopio

- Mario Acquaviva

- Mauro jr. Stefanini

- Michail Bakunin

- Onorato Damen

- Ottorino Perrone (Vercesi)

- Paul Mattick

- Rosa Luxemburg

- Vladimir Lenin

Politics

- Anarchism

- Anti-Americanism

- Anti-Globalization Movement

- Antifascism and United Front

- Antiracism

- Armed Struggle

- Autonomism and Workerism

- Base Unionism

- Bordigism

- Communist Left Inspired

- Cooperativism and Autogestion

- DeLeonism

- Environmentalism

- Fascism

- Feminism

- German-Dutch Communist Left

- Gramscism

- ICC and French Communist Left

- Islamism

- Italian Communist Left

- Leninism

- Liberism

- Luxemburgism

- Maoism

- Marxism

- National Liberation Movements

- Nationalism

- No War But The Class War

- PCInt-ICT

- Pacifism

- Parliamentary Center-Right

- Parliamentary Left and Reformism

- Peasant movement

- Revolutionary Unionism

- Russian Communist Left

- Situationism

- Stalinism

- Statism and Keynesism

- Student Movement

- Titoism

- Trotskyism

- Unionism

Regions

User login

This work is licensed under a Creative Commons Attribution 3.0 Unported License.