You are here

Home ›Stock market falls presage capitalist war

The fundamental business of the country, that is production and distribution of commodities, is on a sound and prosperous basis.

Herbert Hoover, October 25th 1929

-

I want you to know the economy, our economy, is fundamentally strong.

George W. Bush, July 15th 2002

As we said a couple of issues ago, the gigantic financial deception which lay at the heart of Enron and what was then the biggest bankruptcy in US history...

is not an isolated case but [is] symptomatic of the global financial crash capitalism is building up for itself.

RP24, “Enron: The Shape of Capitalism Today”

Since then a day hasn’t passed without a ‘revelation’ of some sort of company executive fraud or financial scam as insolvencies multiply and stock market values tumble. In June the collapse of telecoms giant WorldCom gave it the edge over Enron for the dubious title of the world’s largest-ever bankruptcy. It is now plain to all that the financial bubble which added $12,000bn to the nominal value of the US stock market in less than six years has finally burst. As ‘public confidence in corporate governance’ evaporates the US political establishment has taken up the task of re-polishing the tarnished image of American capitalism. The criminal investigation into Enron was followed by the prosecution and financial demise of its accounting firm, Arthur Andersen. It has become commonplace for companies to face criminal or civil prosecutions for financial ‘wrongdoings’ which were once themselves accepted as standard practice. Thus, big names like Merrill Lynch and Xerox have been obliged to pay out $100m and $10m respectively in fines. (Executives from some firms even face prison.) However, this cynical exercise in damage limitation has been no more effective than Greenspan’s remarks about “infectious greed” or Bush’s inept speeches of “hangovers after binges” at reversing the ‘bear market [falling share prices]. - In fact each time Bush has made an attempt at a rallying speech share prices have fallen further.

The current bear market has now been running for over two years. New technology share prices - where most of the big bankruptcies have occurred - have fallen most dramatically (73%) but the overall value of US quoted stocks (new technology and old economy) has now dropped by 40% from their peak in 2000. This compares with an 89% drop in share values in the 34 month decline that followed the Wall Street crash of 1929; a 48% wiping out of value over the 21 month bear market of 1972-74 and a 32% loss in just two months during the 1987 crash. As for regaining lost values, it took 25 years of worldwide economic depression and the capital destruction of a world war before the Dow Jones eventually regained its September 1929 peak in 1954. It was a decade before US equity indices recovered their 1972 level while it took only two years for stocks to get back to the values wiped out in 1987.

Of course none of these stock market crises have been, or could be, limited to the US, nor have they occurred in an economic vacuum or simply as a result of speculators’ greed. They all emanate from the cyclical crises in capital accumulation that world capitalism has endured since the beginning of the last century.

The only way capitalism itself can only resolve these crises is by capital depreciation and devaluation, ultimately on a scale so massive that war is the only way to recovery, just as it was in the 1930s. In this context the 1972-74 stock market crash has to be seen as belonging to the opening stages of the present world crisis which marked the end of the post-war boom and the beginning of the downswing in the accumulation cycle. From an anticapitalist perspective, the re-opening of economic crisis in the heartlands of capital also brought with it the prospect of the development of a revolutionary solution as the working class responded en masse to the attacks on living standards wrought by spiralling inflation.

Interestingly enough the impact of the 1972-74 crash (a 52% drop in share values) was harder on the London stock market than it was on Wall Street at the time or on the London market between 1929-32. Whilst the plight of London stock jobbers was marginal to the class struggle that was raging at the time and which brought a reawakening of revolutionary political consciousness, it seems that the end of capitalism was also being contemplated from the other side of the class divide. In a book on the history of the City of London financiers who lived through that crash reveal the extent of their fears and draw a picture of a fearful capitalist class: the Queen Mother praying for an upturn in the market, people cashing in equities and burying Kruegerrands in the garden; in short, panic. Or as one stock jobber is quoted:

I thought it was the end of the capitalist system, I really did. (1)

If only... Here is not the place to go over the details of how international capitalism came to survive the initial impact of economic crisis: how deficit financing in the 1970’s and the end of fixed exchange rates brought inflation and a massive

offensive against the working class, producing large scale unemployment and the economic restructuring of the 1980’s, in turn paving the way towards a ‘flexible’ labour force which accepted the introduction of new technology and enabled globalisation of production and labour markets.

Moreover, despite the abandonment of fixed exchange rates, the main pillar of the Bretton Woods postwar settlement, designed to avoid any repeat of the competitive devaluations and trade wars which led to real war in the 1930’s, the US was still inclined to coordinate its response to the economic crisis with the other Western powers due to the polar threat from the other superpower, the USSR. Thus the G7 countries determined how GATT would give way to the World Trade Organisation whose rules they devised to open up the rest of the world to their own competing capitals.

At the same time the US accepted the participation of European and Far Eastern capital in the financial globalisation which resulted first from the freeing of international currency exchange rates and then magnified and spread to unprecedented levels with the introduction of electronic trading in everything from commodities and currencies, to shares and debt in all its mysterious forms. While American speculators moved in to ensure their cut of the City of London trade when it was deregulated with the ‘Big Bang’ of the Eighties, US capital in general could assure itself of global financial domination by virtue of its position as holder of the world’s principal unit of account and international trade - the dollar.

Thus, the US led the way in the revival of stock market trading and the boom in profit-making from revenues received for financial ‘services’ - anything from fees for overseeing company mergers and acquisitions to the rake off from selling shares - which are increasingly divorced from the production of surplus value (the so-called real economy). And even though the US current account deficit swelled the dollar held up because US financial markets continued to attract foreign investment funds. Not so today.

In April the Financial Times estimated that the US needed to attract an investment inflow of S1.5bn per day to offset this deficit while in reality the net inflow for one month - January - had been $9.5bn. Now the situation is worse. Investors are pulling out funds from the US. The almighty dollar is now losing value. (Almost 6% in real terms since its peak in January this year and 20% in relation to the Euro since mid-2000.)

No wonder Bush has joined up with Congress to introduce legal regulation designed to demonstrate to the world there is ‘corporate responsibility’ in the US. Some hope. Corporate executives in the US have led the way in the realm of financial speculation and the generation of fictitious capital. Increasingly they have been concerned, not so much about the financing of business in order to produce at a profit but about the business of finance in order to make a quick buck. News that executives from the top twenty-five of US recent bankruptcies managed to ‘earn’(!) $3.3bn dollars over three years while their companies lost over $210bn only confirms this. (Over 94,000 jobs were also lost: a relatively small number compared to the supposed capital values of the companies involved.) Yet, even in capitalist terms there is still an enormous discrepancy between the market price of shares and the earnings they generate (never mind the capital value of the companies involved).

Measures of underlying value suggest that the market is still more generously valued than at any period in the past 100 years, apart from the peak of the recent bubble and in 1929. On a trade-weighted basis, the US dollar is 35 per cent higher than in May 1995. Estimates of the real exchange rate suggest the dollar remains almost as high as in 1985.

Financial Times 12.6.02

In other words, there is still some way to go before this current ‘readjustment’ of share prices is over and plenty of room for the dollar to lose out even further against the Euro and the Yen. The stock market bubble may have burst but the reverberations have not finished yet. As with previous stock market crashes this one is not limited to the US. (35% has been wiped off world stock market values since their peak in April 2000.) However, the US was supposed to be the engine of world capitalist growth. Instead it is the harbinger of world depression and

further financial crisis beyond the stock market itself. We are not interested in predicting when this particular bear market will be over but we can say with certainty that the US capitalist class as a whole is not going to sit idly by and watch further economic collapse and the dollar lose out to the advantage of their competitors in the fight for control of the world’s wealth... A small war which threatened oil supplies and renewed trust in the dollar might be just what is required...

E.RaynerSo it is, too, with the money market. As soon as trade in money becomes separate from trade in commodities it has - under certain conditions imposed by production and commodity trade and within these limits - a development of its own, special laws determined by its own nature, and separate phases. If to this is added that money trade, developing further, comes to include trade in securities and that these securities are not only government papers but also industrial and transport stocks, so that money trade gains direct control over a portion of the production by which, taken as a whole, it is itself controlled, then the reaction of money trading on production becomes still stronger and more complicated. The traders in money are the owners of railways, mines, iron works, etc. These means of production take on a double aspect: their operation has to be directed sometimes in the interest of direct production but sometimes also according to the requirements of the shareholders, so far as they are money traders. The most striking example of this is furnished by the North American railways, whose operation is entirely dependent on the daily stock exchange operations of a Jay Gould or a Vanderbilt, etc., which have nothing whatever to do with the particular railway and its interests as a means communication. And even here in England we have seen contests lasting decades between different railway companies - contests on which an enormous amount of money was thrown away, not in the interests of production and communication but simply because of a rivalry whose sole object was to facilitate the stock exchange transactions of the share-holding money traders.

Engels to Conrad Schmidt, October 27th 1890

(1) City State: a Contemporary History of the City of London and How Money Triumphed, Richard Roberts and David Kynaston.

Revolutionary Perspectives

Journal of the Communist Workers’ Organisation -- Why not subscribe to get the articles whilst they are still current and help the struggle for a society free from exploitation, war and misery? Joint subscriptions to Revolutionary Perspectives (3 issues) and Aurora (our agitational bulletin - 4 issues) are £15 in the UK, €24 in Europe and $30 in the rest of the World.

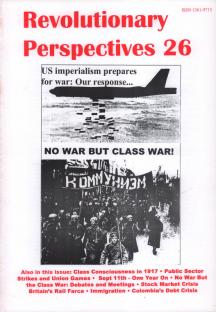

Revolutionary Perspectives #26

Start here...

- Navigating the Basics

- Platform

- For Communism

- Introduction to Our History

- CWO Social Media

- IWG Social Media

- Klasbatalo Social Media

- Italian Communist Left

- Russian Communist Left

The Internationalist Communist Tendency consists of (unsurprisingly!) not-for-profit organisations. We have no so-called “professional revolutionaries”, nor paid officials. Our sole funding comes from the subscriptions and donations of members and supporters. Anyone wishing to donate can now do so safely using the Paypal buttons below.

ICT publications are not copyrighted and we only ask that those who reproduce them acknowledge the original source (author and website leftcom.org). Purchasing any of the publications listed (see catalogue) can be done in two ways:

- By emailing us at uk@leftcom.org, us@leftcom.org or ca@leftcom.org and asking for our banking details

- By donating the cost of the publications required via Paypal using the “Donate” buttons

- By cheque made out to "Prometheus Publications" and sending it to the following address: CWO, BM CWO, London, WC1N 3XX

The CWO also offers subscriptions to Revolutionary Perspectives (3 issues) and Aurora (at least 4 issues):

- UK £15 (€18)

- Europe £20 (€24)

- World £25 (€30, $30)

Take out a supporter’s sub by adding £10 (€12) to each sum. This will give you priority mailings of Aurora and other free pamphlets as they are produced.

ICT sections

Basics

- Bourgeois revolution

- Competition and monopoly

- Core and peripheral countries

- Crisis

- Decadence

- Democracy and dictatorship

- Exploitation and accumulation

- Factory and territory groups

- Financialization

- Globalization

- Historical materialism

- Imperialism

- Our Intervention

- Party and class

- Proletarian revolution

- Seigniorage

- Social classes

- Socialism and communism

- State

- State capitalism

- War economics

Facts

- Activities

- Arms

- Automotive industry

- Books, art and culture

- Commerce

- Communications

- Conflicts

- Contracts and wages

- Corporate trends

- Criminal activities

- Disasters

- Discriminations

- Discussions

- Drugs and dependencies

- Economic policies

- Education and youth

- Elections and polls

- Energy, oil and fuels

- Environment and resources

- Financial market

- Food

- Health and social assistance

- Housing

- Information and media

- International relations

- Law

- Migrations

- Pensions and benefits

- Philosophy and religion

- Repression and control

- Science and technics

- Social unrest

- Terrorist outrages

- Transports

- Unemployment and precarity

- Workers' conditions and struggles

History

- 01. Prehistory

- 02. Ancient History

- 03. Middle Ages

- 04. Modern History

- 1800: Industrial Revolution

- 1900s

- 1910s

- 1911-12: Turko-Italian War for Libya

- 1912: Intransigent Revolutionary Fraction of the PSI

- 1912: Republic of China

- 1913: Fordism (assembly line)

- 1914-18: World War I

- 1917: Russian Revolution

- 1918: Abstentionist Communist Fraction of the PSI

- 1918: German Revolution

- 1919-20: Biennio Rosso in Italy

- 1919-43: Third International

- 1919: Hungarian Revolution

- 1930s

- 1931: Japan occupies Manchuria

- 1933-43: New Deal

- 1933-45: Nazism

- 1934: Long March of Chinese communists

- 1934: Miners' uprising in Asturias

- 1934: Workers' uprising in "Red Vienna"

- 1935-36: Italian Army Invades Ethiopia

- 1936-38: Great Purge

- 1936-39: Spanish Civil War

- 1937: International Bureau of Fractions of the Communist Left

- 1938: Fourth International

- 1940s

- 1960s

- 1980s

- 1979-89: Soviet war in Afghanistan

- 1980-88: Iran-Iraq War

- 1982: First Lebanon War

- 1982: Sabra and Chatila

- 1986: Chernobyl disaster

- 1987-93: First Intifada

- 1989: Fall of the Berlin Wall

- 1979-90: Thatcher Government

- 1980: Strikes in Poland

- 1982: Falklands War

- 1983: Foundation of IBRP

- 1984-85: UK Miners' Strike

- 1987: Perestroika

- 1989: Tiananmen Square Protests

- 1990s

- 1991: Breakup of Yugoslavia

- 1991: Dissolution of Soviet Union

- 1991: First Gulf War

- 1992-95: UN intervention in Somalia

- 1994-96: First Chechen War

- 1994: Genocide in Rwanda

- 1999-2000: Second Chechen War

- 1999: Introduction of euro

- 1999: Kosovo War

- 1999: WTO conference in Seattle

- 1995: NATO Bombing in Bosnia

- 2000s

- 2000: Second intifada

- 2001: September 11 attacks

- 2001: Piqueteros Movement in Argentina

- 2001: War in Afghanistan

- 2001: G8 Summit in Genoa

- 2003: Second Gulf War

- 2004: Asian Tsunami

- 2004: Madrid train bombings

- 2005: Banlieue riots in France

- 2005: Hurricane Katrina

- 2005: London bombings

- 2006: Comuna de Oaxaca

- 2006: Second Lebanon War

- 2007: Subprime Crisis

- 2008: Onda movement in Italy

- 2008: War in Georgia

- 2008: Riots in Greece

- 2008: Pomigliano Struggle

- 2008: Global Crisis

- 2008: Automotive Crisis

- 2009: Post-election crisis in Iran

- 2009: Israel-Gaza conflict

- 2006: Anti-CPE Movement in France

- 2020s

- 1920s

- 1921-28: New Economic Policy

- 1921: Communist Party of Italy

- 1921: Kronstadt Rebellion

- 1922-45: Fascism

- 1922-52: Stalin is General Secretary of PCUS

- 1925-27: Canton and Shanghai revolt

- 1925: Comitato d'Intesa

- 1926: General strike in Britain

- 1926: Lyons Congress of PCd’I

- 1927: Vienna revolt

- 1928: First five-year plan

- 1928: Left Fraction of the PCd'I

- 1929: Great Depression

- 1950s

- 1970s

- 1969-80: Anni di piombo in Italy

- 1971: End of the Bretton Woods System

- 1971: Microprocessor

- 1973: Pinochet's military junta in Chile

- 1975: Toyotism (just-in-time)

- 1977-81: International Conferences Convoked by PCInt

- 1977: '77 movement

- 1978: Economic Reforms in China

- 1978: Islamic Revolution in Iran

- 1978: South Lebanon conflict

- 2010s

- 2010: Greek debt crisis

- 2011: War in Libya

- 2011: Indignados and Occupy movements

- 2011: Sovereign debt crisis

- 2011: Tsunami and Nuclear Disaster in Japan

- 2011: Uprising in Maghreb

- 2014: Euromaidan

- 2016: Brexit Referendum

- 2017: Catalan Referendum

- 2019: Maquiladoras Struggle

- 2010: Student Protests in UK and Italy

- 2011: War in Syria

- 2013: Black Lives Matter Movement

- 2014: Military Intervention Against ISIS

- 2015: Refugee Crisis

- 2018: Haft Tappeh Struggle

- 2018: Climate Movement

People

- Amadeo Bordiga

- Anton Pannekoek

- Antonio Gramsci

- Arrigo Cervetto

- Bruno Fortichiari

- Bruno Maffi

- Celso Beltrami

- Davide Casartelli

- Errico Malatesta

- Fabio Damen

- Fausto Atti

- Franco Migliaccio

- Franz Mehring

- Friedrich Engels

- Giorgio Paolucci

- Guido Torricelli

- Heinz Langerhans

- Helmut Wagner

- Henryk Grossmann

- Karl Korsch

- Karl Liebknecht

- Karl Marx

- Leon Trotsky

- Lorenzo Procopio

- Mario Acquaviva

- Mauro jr. Stefanini

- Michail Bakunin

- Onorato Damen

- Ottorino Perrone (Vercesi)

- Paul Mattick

- Rosa Luxemburg

- Vladimir Lenin

Politics

- Anarchism

- Anti-Americanism

- Anti-Globalization Movement

- Antifascism and United Front

- Antiracism

- Armed Struggle

- Autonomism and Workerism

- Base Unionism

- Bordigism

- Communist Left Inspired

- Cooperativism and Autogestion

- DeLeonism

- Environmentalism

- Fascism

- Feminism

- German-Dutch Communist Left

- Gramscism

- ICC and French Communist Left

- Islamism

- Italian Communist Left

- Leninism

- Liberism

- Luxemburgism

- Maoism

- Marxism

- National Liberation Movements

- Nationalism

- No War But The Class War

- PCInt-ICT

- Pacifism

- Parliamentary Center-Right

- Parliamentary Left and Reformism

- Peasant movement

- Revolutionary Unionism

- Russian Communist Left

- Situationism

- Stalinism

- Statism and Keynesism

- Student Movement

- Titoism

- Trotskyism

- Unionism

Regions

User login

This work is licensed under a Creative Commons Attribution 3.0 Unported License.