You are here

Home ›Considerations on the New State Capitalism

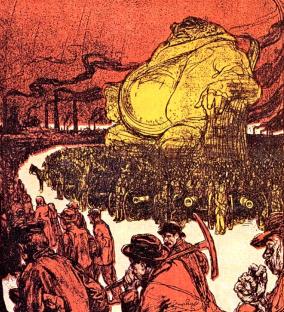

The Italian Prime Minister Meloni keeps on asserting that "it is companies and workers who create wealth, not the state.“ If the so-called "restrained fascists" who are now in government were consistent with their own history this statement would come as a surprise, since their forefather Benito’s response to the crisis of 1929 was to create one of the biggest state capitalist apparatuses in the West, a legacy passed on without a fight to the republic “born out of the Resistance”. To tell the truth, ‘Giorgia's’ precursor was not the only one to mobilise the State in the attempt to pull capital out of the maze of its own contradictions. Mussolini was indeed in great company. Apart from the USSR, where a new form of state capitalism was already being built, we need only recall the New Deal and Nazi Germany, where the state, albeit in different ways, massively participated in the management of the national economy in order to save capitalism from itself. Nevertheless, neither the democratic nor the fascist recipes raised profit rates which were in free fall at the time. Only the war, with its immense destruction of constant capital (factories, infrastructure, etc.) and of variable capital (labour power, i.e. human beings), plus the extraordinary intensification of the rate of exploitation, achieved the goal of giving new impetus to a collapsing system.

In fact war, or an event of a similar magnitude, is the only way capital can untie the Gordian knot of its own contradictions which have reached the end of the line. Nevertheless, even though the post-Second World War cycle of accumulation has been on the downswing since the Seventies of the last century, capitalism has endured thanks to a combination of the Soviet bloc’s defeat in the ‘Cold War’ which involved the drastic devaluation of capital following the collapse of that empire(1) and so-called globalisation. Subsequently, even if state capitalism, expressed to varying degrees and in various ways, had accompanied and supported the thirty ‘Glorious’ post-war boom years, bourgeois ideologues — or rather that bourgeois fringe which has always been hostile (at least in words) to the ‘interference’ of the State in the ‘free market’ (?!) — have had an easy game placing most of the blame for the difficulties that burden the world economy to ‘state dirigisme’. Championed by Reagan and Thatcher(2), the era of so-called neoliberalism opened with the promotion of ‘private’ business and speculation, including the massive sell-off of important chunks of state companies. The dogma — always denied as such — was that only private management of capital could re-establish the rules of the ‘free market’, the prerequisite for healthy and lasting economic growth. It was therefore imperative to free the market from the bonds that statism had tightened around its neck, almost to the point of suffocation. Naturally, amongst all these "snares", regulation of the labour market stood out. This was something the capitalists had adopted during the ascendant phase of the economic cycle, in concert with the trade unions and social democracy (whatever it called itself), as an instrument to control and contain the class struggle within capitalism’s notorious economic, social and political boundaries. Therefore, in parallel with the privatisation of state companies, indeed, as a preliminary step, the war began, which is still ongoing, against the wage-earning class(3) with the aim of imposing a rate of surplus value which would restore the conditions for the development of a new cycle of accumulation on a global scale. The progressive erosion of social services — from healthcare to schools, to pensions and so on — coupled with the passage of their management to private individuals(4), is not strictly a privatisation, but a ruthless theft of the indirect and deferred wages, which the labour force pays into the coffers of the state. In this way, an increasing quota of wages ends up in the pockets of private companies and individuals or remains unused, i.e. lost by the proletariat, to the benefit of public finances or private institutions. We are referring primarily to the health system which, due to cuts made by governments of all stripes, forces ‘service users’ to go to the private sector or to postpone examinations and specialist visits to a later date.

So let us now return to the assertion of Meloni, the newly discovered expert on economics, who, by turning over the family photo — the one from the 1930s — puts another one in full view: the one from the 1920s of the same century when Fascism, as soon as it came to power, hastened to pay its debts to industrialists, farmers, the bourgeoisie of every category who had installed it at the top of the state. Thus a liberal economic policy was adopted which ‘freed’ the mythological market from the statist ‘trappings’ of wartime and from the ‘reformist compromise’ which had been used during the Red Two Years to first anaesthetise, and then strangle, the revolutionary thrust of the proletariat. Two different approaches in two different moments of the accumulation process to achieve the same goal: the defence of the bourgeoisie and the crushing of the working class. In that lapidary sentence, which condenses the most trite, but also hypocritical, clichés of bourgeois thought, two things are true and one is false. The false one, of course, is that it is companies who produce the wealth because it is the working class who really does the producing. (The first true thing.) But it can only do so as long as its exploitation adequately remunerates capital, within a certain time period and in ways that permit its valorisation: the only raison d'être of any company. If the potential or actual ‘workers’ are numerically ‘exuberant’,(5) then there is unemployment, underemployment (read precariousness), low wages, all directly operating to re-establish conditions which allow a more intense extortion of surplus value from the physically and mentally fatigued worker.

It is also true that the state generally does not create wealth, but if state-owned enterprises produce and sell goods like any other enterprise, then the state, like any capitalist, can be said to create wealth in keeping with the standpoint of the bourgeoisie.(6)

But this is not what Meloni is referring to when she pontificates on the economic role of the state. Her intention, in line with the wishes of Confindustria (7) and of the ravenous petty bourgeoisie who fanatically support it, is to transfer as much ‘wealth’ as possible from the pockets of those who actually produce it, the working class, to every calibre and whatever company name, precisely through the kind of state interventions which they say they abhor. The methods are the same as always. They were used by those who were in government before and will be by those who come after. As already mentioned, the means include robbery of indirect and deferred wages, freezing and reducing wages and salaries, not least those in public administration, tax cuts for high incomes (an incentive for tax evasion), with the inevitable degradation of social services thus significantly worsening the quality of life of the working class.

If it is true, therefore, that in theory — but also in practice, with the broad ‘exceptions’ mentioned above — the state does not create wealth, it nevertheless has a fundamental role in supporting the economy: compared to ‘traditional’ state capitalism the form and methods of ‘public’ intervention have changed, but not its central importance. This importance is not connected to recent dramatic events, triggered by the pandemic — if indeed such a conjecture has been made — but from much further back, from the transformation of capitalism over a century ago. Although a self-regulating market, free from external interference, never really existed, the arrival of monopoly, generated by competition — itself produced and accelerated by the ‘most important law of capital’, the tendency of the average rate of profit to fall — prompted increasing concentration and centralisation of capital, thereby closing the ‘liberal’ phase of capitalism. The result was imperialism and growing state intervention: no longer as a simple stick ‘to keep the working class in its place’, but an indispensable part of the economic process as well as the management/administration of bourgeois society.(8) The complexity and enormous investment required for new infrastructure in these sectors with a very high organic composition of capital (for example, railways, communication routes), meant low profits and pushed the bourgeoisie into delegating to the state investments which are indispensable for the capitalist system, but which are unrewarding in terms of profit.

Of course, this was not the case for all bourgeoisies(9) nor to an equal extent, but above all for those who arrived late on the scene of industrialisation where the use of the state organism for ‘developmental’ ends was fundamental (Germany, Italy, Japan…). All the more so for the bourgeoisies that emerged from the so-called national liberation struggles in the second half of the last century, and where even now the state bourgeoisie continues to govern in many of those countries.

It is an evolution, we repeat, that stems from the internal laws of capital and not only constitutes a turning point in the very management of capital but inevitably leads to war, as demonstrated by the first two world imperialist bloodbaths. Plenty of political documents of the immediate post-war period reveal the definitive end of any illusion about free trade and highlight the tendency towards state capitalism as the basis for the bourgeoisie’s actions on both sides of the Atlantic. One example, among many, is an article which states: “The capitalist system can no longer function ‘alone’ as it did in the liberal era: at every moment it needs dirigiste intervention by the State. This is why, despite a pure facade of liberalism, even before the war ended the United States and other countries had to prepare plans for rapid ‘conversion’ to prevent the halt in war production from determining a deep economic crisis, likely to degenerate into a social and political crisis". En passant, so to speak, it was pointed out that “in the current situation, capitalism can only survive by continually reducing the standard of living of the masses”.(10) An extremely pertinent analysis. If it is true that a reduction in the "standard of living of the masses"(i.e. super-exploitation by lowering wages even below the modest value of the time) laid the foundations for rising accumulation in the post-war period and a higher standard of living for the working class (by the way, something that was never freely given), it is no less true today, more than seventy years later, that both the bourgeoisie and the proletariat find themselves in a similar situation, but one moving in the opposite direction.

Today, super-exploitation and impoverishment of the proletariat plus state intervention are not paving the way for a new "economic miracle" (either in Italy or anywhere else). Unable to revive the rate of profit, capitalism is incapable of overcoming its crisis of accumulation. Although in recent decades the state has withdrawn — albeit never completely — from the direct management of companies and entire sectors of public services, it has nevertheless only changed the mode of its intervention in favour of capital.

But before examining the "new" forms of state capitalism, it should be noted that the empty neoliberal rhetoric on privatisations is being overshadowed by a growing phenomenon, watched with apprehension by those who want to hoist the Adam Smith version of the free market flag. Let's give a voice to those who are nostalgic for the Scottish economist:

The State Capitalism that is present all over the world and with activities that sometimes go beyond national borders, includes sovereign funds (Sovereign Wealth Funds, SWF) and companies controlled (or over which significant influence is exercised) by central or local governments (State Owned Enterprises, SOE). The importance of these companies is highlighted in an IMF report: in 2018 the share of SOE assets among the 2000 largest (non-financial) companies in the world was 20%, double that of ten years before, with a total value of $45,000 billion. Equal to about 50% of world GDP in 2018.(11)

According to the author of this report, the causes of this revival of ‘classical’ state capitalism are to be found in negative structural changes involving the world economy. We can translate this into an exacerbation of imperialist tensions due to mounting difficulties in the accumulation process, to the investments required to cope with them, but whose profitability is uncertain or in any case projected over a long time. Such a complicated picture “makes us think then of the need for patient capital, and therefore that the role of the State will be increasingly present”.(12) But capital by its nature is not, and cannot be, patient, and for this reason too, as we said, it has never been left entirely at the mercy of its laissez faire. On the contrary, the state has intervened with impressive firepower every time the long historical crisis that began over half a century ago rears its head.

Incidentally, this does not mean that there is any validity in the reformists’ fantasy that there is money for the ‘subordinate classes’ or that ‘another world is possible’ within bourgeois society. The bourgeoisie finds the money — or rather, it ‘invents’ it with debt and other financial ‘magic’ — but only for its own class, not for the proletariat, its historical antagonist, who, indeed, is blamed for the interventions required in favour of capital. The macho slogan, “We Won't Pay for the Crisis”, so loved in certain leftist circles, has never been true, nor can it be true. Until we take power and draw a definitive line under bourgeois society we, the proletariat, will always pay for the bosses' crises. In truth, the reformist world, in all its variants, is in no position to have a coherent class vision of the world of capital and inevitably gets lost in its own smokescreens. Not a problem, if it didn't also pollute individual mindsets and more combative and instinctively anti-capitalist sectors of the working class…

But to resume the discussion: without the financial firepower deployed by the state in the last fifteen years — not to go further back — the system would have collapsed, from an economic and therefore social point of view. Given the enormous political backwardness of our class, as evidenced by the low influence of the small communist minorities, this does not mean that the proletarian revolution would necessarily have been at the gates. On the one hand, the economic-social upheavals would have accelerated the tendencies towards generalised imperialist conflict, towards fascism-nationalism. On the other hand the political message of revolutionary internationalism would have found a certainly dramatic, if not tragic, confirmation. It is not a question of re-evaluating the dubious slogan of “the worse it is, the better it is”, which in the abstract reeks of mechanical thinking. We need to examine the dialectical movement of the class struggle in the context of the convulsions in the process of capital accumulation and where the existence or absence of the revolutionary organisation rooted in the class (the world or international party) is a fundamental element to be considered.

So, let's recall the broad outline of what state intervention has involved, starting from the shock of 2007-08 that was triggered by the sub-prime mortgage crisis which began in the USA. As well as throwing a vast sector of proletarians into desperation this brought two of the “Big Three” auto companies to the brink of the precipice: Chrysler and General Motors. Obama rescued them by allocating a loan of $80 billion, which, if we are not mistaken, was later repaid, but only through intensified exploitation of the labour force, especially toward new hires, who had to accept significantly lower wages than for the existing workforce. Even so, the entire workforce was forced to suffer worsening of working conditions, including the commitment not to strike for a certain period of time, thanks to the "responsible" agreements signed by the union.

The sub-prime crisis inevitably spread to every sector of the economy of most countries. It caused banks and businesses to go bankrupt and impoverished millions of proletarians who were dispossessed of their homes because they were unable to pay the mortgage, fired, thrown on the dole (where it existed), underemployed, made precarious. According to an online newspaper which cites data from the European Commission, between 2008 and 2011, aid amounting to €1,600 billion was granted “to the banking and financial world”, equivalent to 13% of GDP. Between 2008 and 2010, however, total aid is estimated at €4,589 billion.(13) Thus, a mountain of money made available by governments (not necessarily all spent), which could have been used to help the working class, with health care, etc. But this only happens in the naïve visions of the reformist: i.e. someone who will never really understand that society is divided into classes with irreconcilable interests and that the state is the exclusive tool of the class that exploits, oppresses and rules: today that is the bourgeoisie. Thus, only a part of that money went to the working class through ‘institutions’ for unemployment relief(14), which allowed the sectors (not all) most affected by the crisis to survive by gasping for air, with the clear aim of dampening the dust of the class struggle. On the whole, a successful operation, not least thanks to the unions’ usual "understanding" of the "country's" problems and — an element that we will never tire of emphasising — the absence of a coherent anti-capitalist political compass inside the class. On the other hand, the bourgeoisie, unlike the proletariat, is class-conscious and learns from the past. Thus, it knows that social turbulence can arise from economic turbulence, creating problems in the immediate term and even more in the future ahead. For example, in the years 1929-33, millions of unemployed Americans embarked on widespread and determined struggles, which spread like wildfire and strengthened the small organisations that, rightly or wrongly, called themselves communist (from the Stalinists to the councilists, as well as the Trotskyists). Well, the (partial) absorption of unemployment as a result of the New Deal reduced the combative movement of the jobless to a minimum and, beyond that, made the Left as a whole politically insignificant once again.(15)

The same kind of interventionism, on an even greater scale, arose during the Covid pandemic — a worthy offspring of the capitalist mode of production — when, in order to avoid a collapse of the system, new extraordinary state aid was injected by sharply increasing the public debt. In March 2021, as soon as he was elected, President Biden launched the American Rescue Plan Act, a $1.9 trillion "fiscal stimulus plan". According to a UniCredit economist, “in terms of direct fiscal stimulus (cash), Biden's American Rescue Plan Act plus the 900 billion in aid approved by Trump at the end of last year and an effect of the automatic stabilizers, are equivalent in 2021 to economic support equal to 11-12% of GDP”. Some financial circles speculated that as a result of this “in the period 2021-22 there will be an increase in world exports to the United States equal to $360 billion, of which Western Europe, with $97 billion, would have the largest share”.(16)

But that was not all, because eight months later, almost as if he were Trump's heir,(17) on 15 November Biden signed a new colossal intervention, the Infrastructure Investment and Jobs Act, which allocated “$1,200 billion to improve US infrastructure over the next few years, in order to increase the country's international competitiveness.”(18) Not bad for a state that claims to be the protector of the free market. Only there are many protectors like that around, with the same propensity for licentiousness. In fact the European Union, despite the enormous liability of not being a state in the full sense, has put aside the budget austerity it applied to strangle the Greek proletariat, and has granted budget exemptions via direct and indirect fiscal aid of all kinds. Italy, before and during the Draghi government (who as governor of the ECB held the rudder of austerity very tightly) was, in the opinion of other ‘authoritative’ bankers, the country most helped during the pandemic: “According to one study by Bank of America in the last two and a half years we have received almost 1.4 trillion between public and monetary stimuli: about 69% of GDP. More than the USA, Germany and the world’s poorest countries [...] the country that has received the most aid (as a percentage of GDP) to support and relaunch the economy.”(19) The importance of all this aid is underlined once again by the Court of Auditors, according to which “Two-thirds of Italian growth between now and 2026 is due to the thrust of the PNRR [il Piano Nazionale di Ripresa e Resilienza: The National Plan for Revival and Reslience] because without the Plan the [expected] average annual rate of 1.2% would be reduced to a modest +0.4%, normal for Italy in the twenty years of pre-pandemic stagnation”.(20)

In addition to all that, the war in Ukraine has now given the USA the opportunity to strike hard against the European bourgeoisie and its aspiration of somehow playing a role independent of the two main protagonists of world imperialism: USA and China.

In order to tackle the serious economic difficulties “since last March, against the usual Community rules, Brussels has taken 210 decisions authorising 190 national measures for €673 billion in public subsidies. The large fiscal space available makes Germany the queen of state aid.”(21) Germany has allocated €356 billion, France €162bn, Italy €51bn. Among these appropriations is the re-nationalisation of EDF (the French railways, €10 billion) and the state acquisition (€8 billion) of Uniper, the main German gas distributor. The "large fiscal space available" is the element around the Green Deal Industrial Plan for the “ecological” conversion of European industry which the European countries wrestled over in February during the meeting convened to address the umpteenth knock on the head that US imperialism has given its European friend and ally (?). In fact, some of the EU states, including Italy, are pressing for the establishment of a European sovereign wealth fund. Others, including Germany, do not want to hear of public debt sharing. Thus, a compromise was reached to postpone the question of a possible sovereign wealth fund to the summer. In the meantime, those who have "fiscal spaces available" can grant new aid, once again in derogation of the sacred principles of the free market. Italy, which unlike Germany (and most other states) does not have any ‘spaces’, can instead opt to go beyond the original implementation period of the PNRR, on which it is late. Hence the concern cited above by the Court of Auditors, on behalf of important sections of the Italian bourgeoisie.

NextGenerationEU is not capable of meeting an even more complicated picture of the enormous problems of health, environment, war that intertwine and enhance the economic crisis (from which they originate): the result of a capitalism corroded by cancer that manages to conceal, as we have already said, the fall in the rate of profit. The European “state” then intensified its efforts to prevent its own bourgeoisie from acting as an extra in the theatre of world imperialism. And the greatest danger comes precisely from their "American friend". Stars and Stripes imperialism must have a special relationship with the month of August, since it has now made two moves during the August holiday season that have created great difficulties for enemies and, above all, for friends (or, rather, subordinates).

The first, now historic, is President Nixon's renunciation of the Bretton Woods accords on 15 August 1971, the official start, so to speak, of the structural crisis that ended the post-war boom. The second is the signing of the Inflation Reduction Act (IRA) by Biden on 16 August 2022, a plan (another) worth $738 billion, of which $391 billion are intended for the so-called ‘green’ transition.(22) Perhaps the reformist environmentalists have been rejoicing, but certainly not the European bourgeoisie. In the first place, because the incentives for ‘green’ technologies and production go only to those who produce on American soil or somewhere with a free trade agreement, for example Canada and Mexico, where, coincidentally, US capital has relocated several industrial plants. Protectionism? What is certain is that the American bourgeoisie does not want to run the risk of seeing state incentives end up in the pockets of European and, least of all, Chinese capital who are better equipped, in various sectors, from the point of view of production. On the contrary, they intend to strengthen an industrial system which the race for higher profit rates had in part significantly moved outside the national borders, thus undermining the operational capacity of their own imperialist power. The pandemic, and now the war in Ukraine, have clearly highlighted the risks involved in relocating numerous branches of production, ranging from the most advanced to those considered commonplace but which became indispensable during the pandemic, such as personal protective equipment. They have also exposed the fragility of just-in-time production — above all when this is "spread" across several continents — which works until it is disturbed by outside events (so to speak) and not least by the class struggle, which unfortunately still remains the sleeping giant. In the long run, it is difficult to exercise the role of the world's leading superpower if one does not have an adequate industrial and infrastructural frame. For example, if one does not master the semiconductor supply chain, something that is now fundamental in almost every sector of production, starting with armaments. But today the production of microchips is concentrated in South Korea and, above all, in Taiwan, the object of desire of Chinese imperialism. Here then are the billion-dollar incentives for the domestic production of chips — a practice followed by both the EU and China — and the doors are wide open to the largest semiconductor company in the world, the Taiwanese TSMC, which in Phoenix, Arizona will build a $40 billion plant with 10,000 employees.(23) Of course this means four million dollars for each job, which gives an idea of the very high organic composition of capital, especially in leading sectors, and of the subsequent need, therefore, to raise to equally high levels the extortion of surplus value: the level of exploitation required to merit these gigantic investments. But, as Marx well explained, while the amount of surplus value increases, the rate is progressively reduced, as the organic composition of capital increases, since it cannot keep pace with the increase in itself.(24)

Incentives, protectionism, the opportunity for states to acquire shares in advanced industries, as proposed by Vestager, Vice President of the European Commission, at the February summit on the Green Deal. You can call it whatever you want, but in fact this is state capitalism, if possible even more dominated by capital than the traditional one, because here the state does not take over the individual capitalists in the ownership/management of the enterprise, but leaves them in place and supplies them with the oxygen boosts without which they would die.

It also relieves firms of the burden of wage increases, replacing them with modest surrogates for real wage growth, which, since they are disbursed by ‘public’ finances, are ultimately paid for by the working class, from taxes which, unlike the bourgeoisie, it cannot escape. Among the many possible examples, we mention only a few.

Contrary to his campaign promises, when Biden passed the Infrastructure Act he did not raise the Federal minimum wage to $15 an hour — in many states it is still at the same level as it was in the early 1970s. Neither did he raise the unemployment benefit to $400 a week, but left it at $300. Back in 2014 Renzi, then Prime Minister of Italy, with his Jobs Act, gave the bosses another gun to hold at the head of the working class and, at the same time, has "given" a supplement of €80 per month to the lowest wages/salaries. Finally, to close this very partial overview, the current head of government, that admirer of il Duce, has foisted yet another "package" on the working class with the so-called cut in wage deductions, at the expense of pensions and of the poorest sectors of the proletariat.(25)

But there is another element which underlines how the intervention of the state is a fundamental component of the accumulation of capital, that is via the policies of the central banks. Their role has always been important, it goes without saying, but it has grown in parallel with the difficulties generated by the fall in the rate of profit.

The abolition of controls on certain banking activities which were introduced after 1929, together with removal of restrictions on interest rate policies, have given a powerful boost to speculative finance and debt, in the illusion that it is possible to escape the process of real valorisation of capital, which can only take place in the sphere of production. Making money from money creates huge masses of fictitious capital, so called because the values it is supposed to represent have not yet materialised, they are just a ‘promise’ of future values. Since surplus value extorted in the production process is scarce,(26) debt is created, interest rates are lowered to zero or even below zero, while money is introduced in gigantic quantities into the economic circuit (so-called monetary policy accommodation or Quantitative Easing), through the purchase of securities and bonds. But, as the evidence demonstrates, all this money does not stimulate the real economy (production), it mostly ends up in the vicious circle of financial speculation, because, once again, productivity is lagging behind.

We must not forget that productivity for capital does not simply mean more ‘things’, more commodities, but commodities which contain a quantity of surplus value such as to justify the investment, in terms of the rate of profit. So far this monetary version of the multiplication of loaves and fishes has avoided the collapse of the world economy, but it aggravates aspects of the crisis, keeping unprofitable companies (zombie companies) alive, deepening the deficit and increasing debt. Not even the decades-long reduction in taxation on capital and the wealthy in general, a ferocious palliative to the declining rate of profit, solves the problem: the ‘propensity’ to invest remains weak, ‘social’ services are being brutally cut and there is not even a remote sign of wealth dripping downwards as theorised by neoliberals. On the contrary, there is a transfer of wealth from the bottom upwards. Obviously, a part of the bourgeoisie, the most aware, is alert to the dangers of the situation for the stability of the system and, probably without knowing it, their analysis of the present state of things, up to a certain point, is close to ours. There are those who, due to the size of debt, the burgeoning of fictitious capital and the intervention of state institutions, have been saying in no uncertain terms that we are facing war economy interventions, even a de facto nationalisation of the economy, well before the pandemic. Indeed, one of those “thinking heads” states that:

When a central bank acquires — through pure and simple monetary creation — the equivalent of 3⁄4 of the national economy, problematic results are obtained: 1) a certain form of “nationalisation” of the economy by the issuing institution [followed by] the substitution of a public body for market forces [...] limitations on the Central Bank in relation to the public authorities are generally not to be found, as in times of war when governments of national defence set rates.

In support of his theses, the author of these considerations introduces a shocking fact, for a ‘sound’ management of the economy according to a classic (or almost) bourgeois point of view:

The fact that a central bank like the ECB has decided to buy bonds worth more than 70% of eurozone GDP gives an idea of the unheard-of extent of the explosion that occurred after 2014 in terms of monetary support for the economy.(27)

For him, as for us, the fundamental point is that productive investments have been declining for twenty years (at least, we might add), as well as productivity,(28) and that the guarantee, i.e. the bailout practised by states for banks and financial institutions in general threatened by bankruptcy due to their casual speculation, does nothing but encourage speculation itself, at the expense of the “nation”, i.e. we specify, of the proletariat. Far more lucid than reformism, he points the way out of this vicious circle: we need to “re-establish the remuneration of productive investment, encouraging work rather than redistribution”.(29)

The bourgeoisie is trying its hardest to encourage work, with pension ‘reforms’, with the attack on so-called ‘welfare’ and the passage to workfare; it lowers wages, exacerbates underemployment or precariousness, increases the “industrial reserve army” (unemployment) in an attempt to re-establish the profitability of productive investment. In many countries it offers generous incentives for refurbishment of machinery,(30) which constitutes, like the other forms of support, a nice breath of fresh air for the sectors/individuals involved, but — and we return to the starting point — however much money the state injects into the economic system, that injection cannot rejuvenate a decrepit organism, since the high organic composition of capital makes it difficult to increase that productivity (of surplus value) which is the alpha and omega of capitalism. This is not to mention that the money must be found through taxation, which, as we have said, has been lowered on capital for decades, and which causes the state's debt to further increase. Thus, there is too much capital in search of satisfactory returns which, due to the scarcity of opportunities, throws itself into speculation, obviously including both in public and private debt. According to the former governor of the Bank of France, between 2000 and 2020, “In total, on a world scale, the ratio is 23% of real value created by investment and 77% by the game of valorisations”,(31) i.e. from the various forms of financial speculation. In the USA that ratio could be as high as 13% compared to 87%. At the beginning of 2022 global debt was estimated to be over “$300 trillion (1 trillion = 1000 billion). This figure, an absolute record in peacetime, represents 360% of world GDP”.(32)

As we have seen, for over fifty years capital has been grappling with the manifestation of its main contradiction: the fall in the average rate of profit, trying everything to tame it, not least with ever more extensive use of the state. The ‘ecological transition’ itself which, if we are very optimistic, will at best limit the effects of the climate catastrophe that is now obvious — that legitimate daughter of the desperate search for profit under the pressure of the crisis — is not even conceivable without increased state intervention, however it is presented.

Attacks on working conditions and thus living conditions of the proletariat, environmental catastrophe, impending risk of generalised imperialist war, with its enormous burden of death and destruction: there is enough to raise awareness of the incompatibility between the existence of capital and our own existence, indeed, of life itself. But only the revolutionary proletariat, politically guided by its international party, has the key to getting out of this unsustainable situation: either communism or endless barbarism.

CBBattaglia Comunista

August 2023

Notes:

(1) The privatisation, at bargain prices, of large sectors of the economy and the impoverishment of the working class were the reflection of this. It was a situation comparable, in some respects, to a post-war period.

(2) And during Thatcher's rule, despite all the privatisations and the ‘free market’ and ‘small state’ rhetoric, government spending actually rose.

(3) The bourgeoisie is never at peace with the working class (i.e. wage labour), since it must guarantee submission to the extortion of surplus value, i.e. to exploitation, the pivot of bourgeois society.

(4) Or management according to private criteria, even when they continue to be ‘public’.

(5) As an ignoble bourgeois euphemism used to define the proletarians in excess of the needs of the capitalist economic process.

(6) See, the companies of IRI or, today, ENI, a state-owned company that survived the privatisations, which continues to ‘produce wealth’ by extorting surplus value from its workforce. Not to mention, of course, the state capitalism of the former USSR and that still largely in force in China.

(7) General Confederation of Italian Industry: equivalent to the UK’s recently discredited CBI.

(8) Engels' analysis of the state and the evolution towards state capitalism in Anti-Dühring are masterful and, in essence, have lost none of their validity. See: marxists.org

(9) Up until the 1930s, state ‘intrusion’ into the economy in the United States was less than in other countries, but they enjoyed particularly favourable conditions, which other bourgeoisies did not have.

(10) Lo Stato, consiglio di amministrazione della borghesia, Battaglia Comunista no. 21-22, June, 1948. The article is a translation from L'Internationalliste, Bulletin of the Belgian Fraction, May 1948.

(11) Gianluca Sabbadini, The Adam Smith Society, in lamiafinanza.it, 2 July 2022. The IMF study referred to is: International Monetary Fund: State-Owned Enterprises: The Other Government, Fiscal Monitor, Chapter 3, April 2020, imf.org. Just a reminder that the bourgeoisie are free only vis-à-vis the working class. Between the end of May and the beginning of June, some exponents of Confindustria expressly asked the state to join Stellantis, supported, needless to say, by the unions, to better face competition from car manufacturers who "boast" that they already enjoy the shareholding of the ‘public’ (Renault, VolksWagen, etc.).

(12) G. Sabbadini, loc. cit.

(13) See Martine Orange, Mediapart, 21 December 2012 and 4 December 2010, respectively.

(14) The Italian state operated a system whereby workers who were laid off by the company were not unemployed but temporarily received a (reduced) wage.

(15) See Paul Mattick, Arbeitslosigkeit, Arbeitslosenfürsorge und Arbeitslosenbewegung in den Vereinigten Staaten [Unemployment and the Unemployed Movement in the USA], 1936. This particular document is not available in English, but on the same topic from the same author see also: criticadesapiedada.com.br. Disappointment at the partiality of the results of the New Deal led, in 1936, to a recovery in the unemployed movement, albeit on a smaller scale; it was only the war that reabsorbed them and caused the movement itself to disappear.

(16) The quotes are taken from: Attilio Geroni, Il maxi piano Biden sarà il battistrada del nuovo Patto europeo di stabilità?, 24plus.ilsole24ore.com, 22nd March 2021.

(17) Beyond the individual, himself halfway between cabaret artist and gangster, or more simply fascist, this confirms that so-called deglobalisation and "Make America Great Again", respond to a basic need of American capital and its bourgeoisie. Thus, the ways of implementation may change, but the trend remains.

(18) Sarah Pasetto, Constitutional Court, Studies Service, Comparative Law Area, cortecostituzionale.it, November 2021.

(19) Eugenio Occorsio, Ristori, Pnrr e soldi della Bce: l'Italia è il paese più “aiutato” del mondo, repubblica.it, 25 July 2022.

(20) Gianni Trovati, Italia appesa al Pnrr: dal piano i due terzi della crescita del Pil entro il 2026, 24plus.ilsole24ore.com, 26 May 2023.

(21) Aiuti di Stato, ecco la classifica UE: Germania prima, Italia terza, ilsole24ore.com, 12 February 2023.

(22) See Christian Marazzi, Diario della crisi – Il collasso del paradigma postfordista, sinistrainrete.info, 21 February 2023.

(23) Luca Celada, La guerra economica a colpi di chip. Biden “internalizza” Taiwan, ilmanifesto.it, December 22, 2022.

(24) On the limits to increasing productivity, see Karl Marx, Grundrisse, marxists.org, and Capital, Vol. I, Chapter 15, marxists.org

(25) See: leftcom.org

(26) Paradoxically, despite the high levels of exploitation, the working class is not exploited enough to remunerate the capital invested or which should be invested to continue the cycle of the enlarged reproduction of capital. The explanation is, once again, in those pages of Marx quoted in footnote 24.

(27) Jacques de Larosière, En finir avec le règne de l'illusion financière. Pour une croissance réelle [An End to the Reign of Financial Illusion. For Real Growth], Odile Jacob, 2022, pp.70-71. The author was a director of the IMF, governor of the Banque de France and president of the European Bank for Reconstruction and Development.

(28) J. de Larosière, loc. cit., pp.30 and 38, where there is a graph illustrating the decline.

(29) J. de Larosière, loc. cit., p.104.

(30) As far as Italy is concerned, “in the four-year period 2020-2023 [...] Italian consumption [i.e. investment] in new machines should reach €112 billion (on average €28 billion per year) [compared to 2012-15 that is an increase of 59%] to which the Industry 4.0 Plan makes a fundamental contribution», in Marco Fortis, Industria 4.0 ha trascinato la ripresa del Pil italiano, ridimensionarlo è un errore, 24plus.ilsole24ore.com, 18 January 2023. The Plan in question was launched by Prime Minister Matteo Renzi in 2016.

(31) J. de Larosière, op. cit. page 113.

(32) J. de Larosière, loc cit. page 15 and on page 17 specifies that “While the part of the debt of non-financial companies classified as BBB (i.e. the lowest position amongst the good quality companies called investment grade) represented 25% of the market in Europe and 40% in the United States in 2011, today the figures are equal to 50%.”

Start here...

- Navigating the Basics

- Platform

- For Communism

- Introduction to Our History

- CWO Social Media

- IWG Social Media

- Klasbatalo Social Media

- Italian Communist Left

- Russian Communist Left

The Internationalist Communist Tendency consists of (unsurprisingly!) not-for-profit organisations. We have no so-called “professional revolutionaries”, nor paid officials. Our sole funding comes from the subscriptions and donations of members and supporters. Anyone wishing to donate can now do so safely using the Paypal buttons below.

ICT publications are not copyrighted and we only ask that those who reproduce them acknowledge the original source (author and website leftcom.org). Purchasing any of the publications listed (see catalogue) can be done in two ways:

- By emailing us at uk@leftcom.org, us@leftcom.org or ca@leftcom.org and asking for our banking details

- By donating the cost of the publications required via Paypal using the “Donate” buttons

The CWO also offers subscriptions to Revolutionary Perspectives (3 issues) and Aurora (at least 4 issues):

- UK £15 (€18)

- Europe £20 (€24)

- World £25 (€30, $30)

Take out a supporter’s sub by adding £10 (€12) to each sum. This will give you priority mailings of Aurora and other free pamphlets as they are produced.

ICT sections

Basics

- Bourgeois revolution

- Competition and monopoly

- Core and peripheral countries

- Crisis

- Decadence

- Democracy and dictatorship

- Exploitation and accumulation

- Factory and territory groups

- Financialization

- Globalization

- Historical materialism

- Imperialism

- Our Intervention

- Party and class

- Proletarian revolution

- Seigniorage

- Social classes

- Socialism and communism

- State

- State capitalism

- War economics

Facts

- Activities

- Arms

- Automotive industry

- Books, art and culture

- Commerce

- Communications

- Conflicts

- Contracts and wages

- Corporate trends

- Criminal activities

- Disasters

- Discriminations

- Discussions

- Drugs and dependencies

- Economic policies

- Education and youth

- Elections and polls

- Energy, oil and fuels

- Environment and resources

- Financial market

- Food

- Health and social assistance

- Housing

- Information and media

- International relations

- Law

- Migrations

- Pensions and benefits

- Philosophy and religion

- Repression and control

- Science and technics

- Social unrest

- Terrorist outrages

- Transports

- Unemployment and precarity

- Workers' conditions and struggles

History

- 01. Prehistory

- 02. Ancient History

- 03. Middle Ages

- 04. Modern History

- 1800: Industrial Revolution

- 1900s

- 1910s

- 1911-12: Turko-Italian War for Libya

- 1912: Intransigent Revolutionary Fraction of the PSI

- 1912: Republic of China

- 1913: Fordism (assembly line)

- 1914-18: World War I

- 1917: Russian Revolution

- 1918: Abstentionist Communist Fraction of the PSI

- 1918: German Revolution

- 1919-20: Biennio Rosso in Italy

- 1919-43: Third International

- 1919: Hungarian Revolution

- 1930s

- 1931: Japan occupies Manchuria

- 1933-43: New Deal

- 1933-45: Nazism

- 1934: Long March of Chinese communists

- 1934: Miners' uprising in Asturias

- 1934: Workers' uprising in "Red Vienna"

- 1935-36: Italian Army Invades Ethiopia

- 1936-38: Great Purge

- 1936-39: Spanish Civil War

- 1937: International Bureau of Fractions of the Communist Left

- 1938: Fourth International

- 1940s

- 1960s

- 1980s

- 1979-89: Soviet war in Afghanistan

- 1980-88: Iran-Iraq War

- 1982: First Lebanon War

- 1982: Sabra and Chatila

- 1986: Chernobyl disaster

- 1987-93: First Intifada

- 1989: Fall of the Berlin Wall

- 1979-90: Thatcher Government

- 1980: Strikes in Poland

- 1982: Falklands War

- 1983: Foundation of IBRP

- 1984-85: UK Miners' Strike

- 1987: Perestroika

- 1989: Tiananmen Square Protests

- 1990s

- 1991: Breakup of Yugoslavia

- 1991: Dissolution of Soviet Union

- 1991: First Gulf War

- 1992-95: UN intervention in Somalia

- 1994-96: First Chechen War

- 1994: Genocide in Rwanda

- 1999-2000: Second Chechen War

- 1999: Introduction of euro

- 1999: Kosovo War

- 1999: WTO conference in Seattle

- 1995: NATO Bombing in Bosnia

- 2000s

- 2000: Second intifada

- 2001: September 11 attacks

- 2001: Piqueteros Movement in Argentina

- 2001: War in Afghanistan

- 2001: G8 Summit in Genoa

- 2003: Second Gulf War

- 2004: Asian Tsunami

- 2004: Madrid train bombings

- 2005: Banlieue riots in France

- 2005: Hurricane Katrina

- 2005: London bombings

- 2006: Anti-CPE movement in France

- 2006: Comuna de Oaxaca

- 2006: Second Lebanon War

- 2007: Subprime Crisis

- 2008: Onda movement in Italy

- 2008: War in Georgia

- 2008: Riots in Greece

- 2008: Pomigliano Struggle

- 2008: Global Crisis

- 2008: Automotive Crisis

- 2009: Post-election crisis in Iran

- 2009: Israel-Gaza conflict

- 2020s

- 1920s

- 1921-28: New Economic Policy

- 1921: Communist Party of Italy

- 1921: Kronstadt Rebellion

- 1922-45: Fascism

- 1922-52: Stalin is General Secretary of PCUS

- 1925-27: Canton and Shanghai revolt

- 1925: Comitato d'Intesa

- 1926: General strike in Britain

- 1926: Lyons Congress of PCd’I

- 1927: Vienna revolt

- 1928: First five-year plan

- 1928: Left Fraction of the PCd'I

- 1929: Great Depression

- 1950s

- 1970s

- 1969-80: Anni di piombo in Italy

- 1971: End of the Bretton Woods System

- 1971: Microprocessor

- 1973: Pinochet's military junta in Chile

- 1975: Toyotism (just-in-time)

- 1977-81: International Conferences Convoked by PCInt

- 1977: '77 movement

- 1978: Economic Reforms in China

- 1978: Islamic Revolution in Iran

- 1978: South Lebanon conflict

- 2010s

- 2010: Greek debt crisis

- 2011: War in Libya

- 2011: Indignados and Occupy movements

- 2011: Sovereign debt crisis

- 2011: Tsunami and Nuclear Disaster in Japan

- 2011: Uprising in Maghreb

- 2014: Euromaidan

- 2016: Brexit Referendum

- 2017: Catalan Referendum

- 2019: Maquiladoras Struggle

- 2010: Student Protests in UK and Italy

- 2011: War in Syria

- 2013: Black Lives Matter Movement

- 2014: Military Intervention Against ISIS

- 2015: Refugee Crisis

- 2018: Haft Tappeh Struggle

- 2018: Climate Movement

People

- Amadeo Bordiga

- Anton Pannekoek

- Antonio Gramsci

- Arrigo Cervetto

- Bruno Fortichiari

- Bruno Maffi

- Celso Beltrami

- Davide Casartelli

- Errico Malatesta

- Fabio Damen

- Fausto Atti

- Franco Migliaccio

- Franz Mehring

- Friedrich Engels

- Giorgio Paolucci

- Guido Torricelli

- Heinz Langerhans

- Helmut Wagner

- Henryk Grossmann

- Karl Korsch

- Karl Liebknecht

- Karl Marx

- Leon Trotsky

- Lorenzo Procopio

- Mario Acquaviva

- Mauro jr. Stefanini

- Michail Bakunin

- Onorato Damen

- Ottorino Perrone (Vercesi)

- Paul Mattick

- Rosa Luxemburg

- Vladimir Lenin

Politics

- Anarchism

- Anti-Americanism

- Anti-Globalization Movement

- Antifascism and United Front

- Antiracism

- Armed Struggle

- Autonomism and Workerism

- Base Unionism

- Bordigism

- Communist Left Inspired

- Cooperativism and autogestion

- DeLeonism

- Environmentalism

- Fascism

- Feminism

- German-Dutch Communist Left

- Gramscism

- ICC and French Communist Left

- Islamism

- Italian Communist Left

- Leninism

- Liberism

- Luxemburgism

- Maoism

- Marxism

- National Liberation Movements

- Nationalism

- No War But The Class War

- PCInt-ICT

- Pacifism

- Parliamentary Center-Right

- Parliamentary Left and Reformism

- Peasant movement

- Revolutionary Unionism

- Russian Communist Left

- Situationism

- Stalinism

- Statism and Keynesism

- Student Movement

- Titoism

- Trotskyism

- Unionism

Regions

User login

This work is licensed under a Creative Commons Attribution 3.0 Unported License.