You are here

Home ›Lessons from Wall Street

State intervention won’t kick-start production but it will add to the production of fictitious capital - From Battaglia Comunista 10 - October 2008

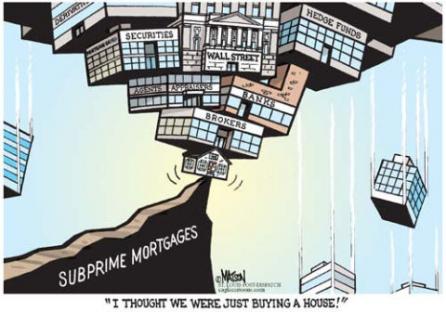

On 3 October 2008 the US legislature approved the $850 billion salvage plan thought up by Treasury Secretary Paulson. This plan is his way of dealing with the dramatic crisis which is bringing the entire world financial system to its knees. The sum provided by Congress will be enough to buy a whole series of shares from the banks which are, in fact, worth about as much as a roll of used toilet paper. In short they are dumping the responsibility for paying for capitalism’s failure on the whole population.

European Wobbles

It seemed in the early stages of the crisis that the old continent was immune to the plague of the sub-prime mortgages but bit by bit, as time as passed, the realisation dawned that the European banks and credit institutions were also engulfed in the chasm of debts. To confront the emergency the major European countries, headed by Italy and France, are trying to complete the same salvage operation carried out by the American government. They favour the formation of a special fund managed directly by the European Central Bank with which they can face up to the liquidity crisis some of whose most important victims are the credit institutions of the old continent. The proposal of the French President Sarkozy backed by Silvio Berlusconi and Giulio Tremonti did not find the necessary agreement from the German Chancellor Angela Merkel who has approved a law in the Bundestag by which the government protects German savers from the danger of having their fingers burned by the failure notice of any credit institution. This cover for German funds is limitless and could reach €1600 billion, a figure double that proposed by the US government. The motives for the German Government going it alone on the road to national salvation rather than joint action of the European Community is because they don’t want to get stuck with the “honour” of building a dam to hold back the flood of bad debt of other banks and credit institutions, especially the British. To those who have been able to make some sense of all the contradictions which have taken place in these the last few years in the process of capital accumulation, this devastating financial crisis has not been unexpected.

The Fruits of Financialisation

It was entirely predictable that the mountain of fictitious capital produced in the last twenty years would end up collapsing. How could anyone think that that adequate returns would continue indefinitely on such a mass of fictitious capital when the basis for the extortion of such surplus value was so relatively restricted? By its very nature fictitious capital does not contribute to the enlargement of the sphere of production and therefore does not produce surplus value. This crisis represents the latest qualitative leap in the more general crisis of accumulation which began in the early seventies which, as we have written many times in our publications, has its origins in the operation of the law of the tendency for the rate of profit to fall. Economic financialisation has been one of the bourgeoisie’s responses to the profits crisis in the productive sectors. For more than twenty years the political economy of the biggest national states and international institutions like the International Monetary Fund has favoured the expansion of the production of fictitious capital giving the illusion that money could be made to create more money without dirtying your hands in the world of production. This crisis has shattered this illusion, and has revealed once again, at an even deeper level and even more dramatically, all the contradictions of the accumulation process. The return of state intervention in the economy (see “State Intervention in the Economy and The End of Neo-liberalism” in Battaglia Comunista 9) should not be seen as a new victory of Keynesianism over neo-liberalism in so far as the manner in which the present crisis is being dealt with falls within the framework of a system which favours the production of even more fictitious capital. State intervention is aimed at supporting the supply side rather than that of the aggregate demand. This means that liquidity is being issued for the financial system to avoid the system collapsing in on itself as a result of unredeemed debts. In any case to see this as a return to Keynesianism represents a romantic view of the functioning of the capitalist system, since what actually determined the financialisation of the economy in the first place was low profit rates in the productive sector. Other crises have broken out in the financial sector but this is the first which hits directly at the core of the international system, the throbbing heart where fictitious capital is produced with the greatest speed, in the most desperate way.

And the Working Class?

The consequences for the proletariat of the metropolitan countries will be dire. It perhaps ends the epoch in which the capitalists of the advanced countries of the world could bestow some presents on their own working class so that in the past Lenin could define them as a workers’ aristocracy. This crisis, more than any other, will have serious consequences for the living and working conditions of the entire world working class. Just how can they expect the enormous volume of liquidity issued by the various states just now to be absorbed by the markets if not through the lowering of wages and a steep increase in the rate of exploitation? It is at this time of crisis that the class struggle becomes sharper. The tragedy is that it is being carried out only by a bourgeoisie which is always clearer in striking at the interests of the workers than the proletariat which until now has stood unarmed against these attacks.

lpStart here...

- Navigating the Basics

- Platform

- For Communism

- Introduction to Our History

- CWO Social Media

- IWG Social Media

- Klasbatalo Social Media

- Italian Communist Left

- Russian Communist Left

The Internationalist Communist Tendency consists of (unsurprisingly!) not-for-profit organisations. We have no so-called “professional revolutionaries”, nor paid officials. Our sole funding comes from the subscriptions and donations of members and supporters. Anyone wishing to donate can now do so safely using the Paypal buttons below.

ICT publications are not copyrighted and we only ask that those who reproduce them acknowledge the original source (author and website leftcom.org). Purchasing any of the publications listed (see catalogue) can be done in two ways:

- By emailing us at uk@leftcom.org, us@leftcom.org or ca@leftcom.org and asking for our banking details

- By donating the cost of the publications required via Paypal using the “Donate” buttons

The CWO also offers subscriptions to Revolutionary Perspectives (3 issues) and Aurora (at least 4 issues):

- UK £15 (€18)

- Europe £20 (€24)

- World £25 (€30, $30)

Take out a supporter’s sub by adding £10 (€12) to each sum. This will give you priority mailings of Aurora and other free pamphlets as they are produced.

ICT sections

Basics

- Bourgeois revolution

- Competition and monopoly

- Core and peripheral countries

- Crisis

- Decadence

- Democracy and dictatorship

- Exploitation and accumulation

- Factory and territory groups

- Financialization

- Globalization

- Historical materialism

- Imperialism

- Our Intervention

- Party and class

- Proletarian revolution

- Seigniorage

- Social classes

- Socialism and communism

- State

- State capitalism

- War economics

Facts

- Activities

- Arms

- Automotive industry

- Books, art and culture

- Commerce

- Communications

- Conflicts

- Contracts and wages

- Corporate trends

- Criminal activities

- Disasters

- Discriminations

- Discussions

- Drugs and dependencies

- Economic policies

- Education and youth

- Elections and polls

- Energy, oil and fuels

- Environment and resources

- Financial market

- Food

- Health and social assistance

- Housing

- Information and media

- International relations

- Law

- Migrations

- Pensions and benefits

- Philosophy and religion

- Repression and control

- Science and technics

- Social unrest

- Terrorist outrages

- Transports

- Unemployment and precarity

- Workers' conditions and struggles

History

- 01. Prehistory

- 02. Ancient History

- 03. Middle Ages

- 04. Modern History

- 1800: Industrial Revolution

- 1900s

- 1910s

- 1911-12: Turko-Italian War for Libya

- 1912: Intransigent Revolutionary Fraction of the PSI

- 1912: Republic of China

- 1913: Fordism (assembly line)

- 1914-18: World War I

- 1917: Russian Revolution

- 1918: Abstentionist Communist Fraction of the PSI

- 1918: German Revolution

- 1919-20: Biennio Rosso in Italy

- 1919-43: Third International

- 1919: Hungarian Revolution

- 1930s

- 1931: Japan occupies Manchuria

- 1933-43: New Deal

- 1933-45: Nazism

- 1934: Long March of Chinese communists

- 1934: Miners' uprising in Asturias

- 1934: Workers' uprising in "Red Vienna"

- 1935-36: Italian Army Invades Ethiopia

- 1936-38: Great Purge

- 1936-39: Spanish Civil War

- 1937: International Bureau of Fractions of the Communist Left

- 1938: Fourth International

- 1940s

- 1960s

- 1980s

- 1979-89: Soviet war in Afghanistan

- 1980-88: Iran-Iraq War

- 1982: First Lebanon War

- 1982: Sabra and Chatila

- 1986: Chernobyl disaster

- 1987-93: First Intifada

- 1989: Fall of the Berlin Wall

- 1979-90: Thatcher Government

- 1980: Strikes in Poland

- 1982: Falklands War

- 1983: Foundation of IBRP

- 1984-85: UK Miners' Strike

- 1987: Perestroika

- 1989: Tiananmen Square Protests

- 1990s

- 1991: Breakup of Yugoslavia

- 1991: Dissolution of Soviet Union

- 1991: First Gulf War

- 1992-95: UN intervention in Somalia

- 1994-96: First Chechen War

- 1994: Genocide in Rwanda

- 1999-2000: Second Chechen War

- 1999: Introduction of euro

- 1999: Kosovo War

- 1999: WTO conference in Seattle

- 1995: NATO Bombing in Bosnia

- 2000s

- 2000: Second intifada

- 2001: September 11 attacks

- 2001: Piqueteros Movement in Argentina

- 2001: War in Afghanistan

- 2001: G8 Summit in Genoa

- 2003: Second Gulf War

- 2004: Asian Tsunami

- 2004: Madrid train bombings

- 2005: Banlieue riots in France

- 2005: Hurricane Katrina

- 2005: London bombings

- 2006: Anti-CPE movement in France

- 2006: Comuna de Oaxaca

- 2006: Second Lebanon War

- 2007: Subprime Crisis

- 2008: Onda movement in Italy

- 2008: War in Georgia

- 2008: Riots in Greece

- 2008: Pomigliano Struggle

- 2008: Global Crisis

- 2008: Automotive Crisis

- 2009: Post-election crisis in Iran

- 2009: Israel-Gaza conflict

- 2020s

- 1920s

- 1921-28: New Economic Policy

- 1921: Communist Party of Italy

- 1921: Kronstadt Rebellion

- 1922-45: Fascism

- 1922-52: Stalin is General Secretary of PCUS

- 1925-27: Canton and Shanghai revolt

- 1925: Comitato d'Intesa

- 1926: General strike in Britain

- 1926: Lyons Congress of PCd’I

- 1927: Vienna revolt

- 1928: First five-year plan

- 1928: Left Fraction of the PCd'I

- 1929: Great Depression

- 1950s

- 1970s

- 1969-80: Anni di piombo in Italy

- 1971: End of the Bretton Woods System

- 1971: Microprocessor

- 1973: Pinochet's military junta in Chile

- 1975: Toyotism (just-in-time)

- 1977-81: International Conferences Convoked by PCInt

- 1977: '77 movement

- 1978: Economic Reforms in China

- 1978: Islamic Revolution in Iran

- 1978: South Lebanon conflict

- 2010s

- 2010: Greek debt crisis

- 2011: War in Libya

- 2011: Indignados and Occupy movements

- 2011: Sovereign debt crisis

- 2011: Tsunami and Nuclear Disaster in Japan

- 2011: Uprising in Maghreb

- 2014: Euromaidan

- 2016: Brexit Referendum

- 2017: Catalan Referendum

- 2019: Maquiladoras Struggle

- 2010: Student Protests in UK and Italy

- 2011: War in Syria

- 2013: Black Lives Matter Movement

- 2014: Military Intervention Against ISIS

- 2015: Refugee Crisis

- 2018: Haft Tappeh Struggle

- 2018: Climate Movement

People

- Amadeo Bordiga

- Anton Pannekoek

- Antonio Gramsci

- Arrigo Cervetto

- Bruno Fortichiari

- Bruno Maffi

- Celso Beltrami

- Davide Casartelli

- Errico Malatesta

- Fabio Damen

- Fausto Atti

- Franco Migliaccio

- Franz Mehring

- Friedrich Engels

- Giorgio Paolucci

- Guido Torricelli

- Heinz Langerhans

- Helmut Wagner

- Henryk Grossmann

- Karl Korsch

- Karl Liebknecht

- Karl Marx

- Leon Trotsky

- Lorenzo Procopio

- Mario Acquaviva

- Mauro jr. Stefanini

- Michail Bakunin

- Onorato Damen

- Ottorino Perrone (Vercesi)

- Paul Mattick

- Rosa Luxemburg

- Vladimir Lenin

Politics

- Anarchism

- Anti-Americanism

- Anti-Globalization Movement

- Antifascism and United Front

- Antiracism

- Armed Struggle

- Autonomism and Workerism

- Base Unionism

- Bordigism

- Communist Left Inspired

- Cooperativism and autogestion

- DeLeonism

- Environmentalism

- Fascism

- Feminism

- German-Dutch Communist Left

- Gramscism

- ICC and French Communist Left

- Islamism

- Italian Communist Left

- Leninism

- Liberism

- Luxemburgism

- Maoism

- Marxism

- National Liberation Movements

- Nationalism

- No War But The Class War

- PCInt-ICT

- Pacifism

- Parliamentary Center-Right

- Parliamentary Left and Reformism

- Peasant movement

- Revolutionary Unionism

- Russian Communist Left

- Situationism

- Stalinism

- Statism and Keynesism

- Student Movement

- Titoism

- Trotskyism

- Unionism

Regions

User login

This work is licensed under a Creative Commons Attribution 3.0 Unported License.