You are here

Home ›Dollar under fire

The reciprocal facilities agreement between Argentina and China which enables them to skip the dollar in their commercial exchanges has arrived in a context of growing questioning of the U.S. Dollar as an international currency.

The agreement announced yesterday allows Argentina to buy Chinese goods with a credit line of 70,000 million yuan (about U.S. $ 10,000 million), while Argentina offers China an equivalent amount in pesos.

China has signed similar agreements with South Korea, Malaysia, Indonesia and Belarus, while Argentina has signed with Brazil.

Last week the Chinese central bank president, Zhou Xiaochuan, surprised many by stating that the current crisis required the creation of a new world currency to replace the dollar.

Speaking to the BBC, the president of Russia Dmitry Medvedev said that the G-20 summit this week must address this issue.

"It is clear that the current monetary system has not helped to deal with the challenges of this," said Medvedev.

One question unthinkable until a few months ago is beginning to become part of the debate triggered by the global economic crisis: Are we at the beginning of the end of the dollar as an international currency? The reign of the dollar, unquestionable since the war, is under the microscope as never before. translation from news.bbc.co.uk

Start here...

- Navigating the Basics

- Platform

- For Communism

- Introduction to Our History

- CWO Social Media

- IWG Social Media

- Klasbatalo Social Media

- Italian Communist Left

- Russian Communist Left

The Internationalist Communist Tendency consists of (unsurprisingly!) not-for-profit organisations. We have no so-called “professional revolutionaries”, nor paid officials. Our sole funding comes from the subscriptions and donations of members and supporters. Anyone wishing to donate can now do so safely using the Paypal buttons below.

ICT publications are not copyrighted and we only ask that those who reproduce them acknowledge the original source (author and website leftcom.org). Purchasing any of the publications listed (see catalogue) can be done in two ways:

- By emailing us at uk@leftcom.org, us@leftcom.org or ca@leftcom.org and asking for our banking details

- By donating the cost of the publications required via Paypal using the “Donate” buttons

The CWO also offers subscriptions to Revolutionary Perspectives (3 issues) and Aurora (at least 4 issues):

- UK £15 (€18)

- Europe £20 (€24)

- World £25 (€30, $30)

Take out a supporter’s sub by adding £10 (€12) to each sum. This will give you priority mailings of Aurora and other free pamphlets as they are produced.

Adverts

Peterborough Bookfair

PETERBOROUGH RADICAL BOOKFAIR

The CWO will have a stall at the Peterborough Radical Bookfair.

When: Saturday, 19 October 2024

Where: The George Alcock Centre, Whittlesey Rd, Stanground, Peterborough PE2 8QS

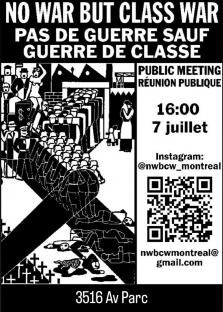

Montreal NWBCW Meeting

NWBCW MONTREAL PUBLIC MEETING

When: Sunday, July 7th 2024, at 16:00

Where: 3516 Av Park

Contact nwbcwmontreal@gmail.com for more info.

Links

User login

This work is licensed under a Creative Commons Attribution 3.0 Unported License.